Penny stocks are often attractive because of their low prices and the potential for significant growth. However, they also come with higher risks. Because penny stocks are shares of smaller companies in the early stages of growth, they tend to be more speculative and volatile.

That said, investing in penny stocks with solid fundamentals early on can lead to impressive rewards. As these companies grow, their stock prices often rise. One way to find promising penny stocks is by looking for those with a “Strong Buy” rating from analysts, which can indicate solid growth potential.

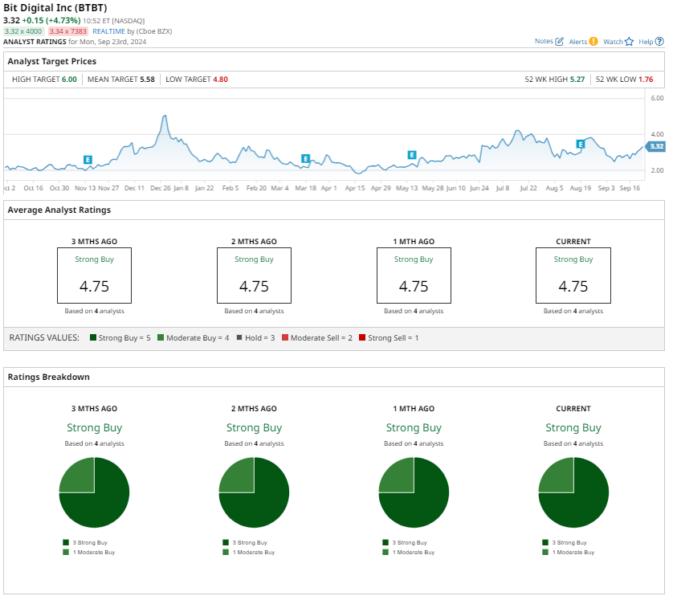

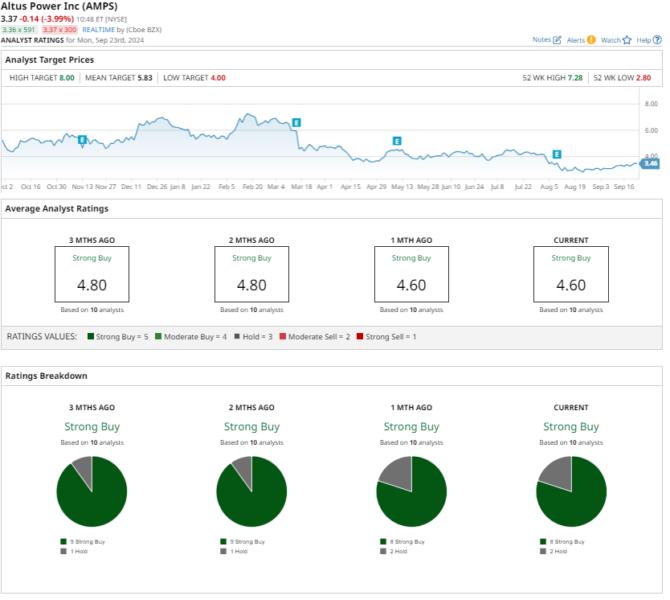

In this context, Bit Digital BTBT and Altus Power

AMPS stand out. Both companies are positioned in high-growth industries, offering strong long-term potential. Most analysts have given them a “Strong Buy” rating. Further, these stocks have at least 68% upside potential, based on their average price targets.

Let’s explore why these penny stocks are a compelling investment.

Penny Stock No. 1: Bit Digital BTBT

Bit Digital BTBT specializes in digital asset mining, Ethereum staking, and high-performance computing (HPC) services for artificial intelligence (AI) applications. The company has diversified its operations with two distinct revenue streams that help to mitigate the volatility risks typically associated with digital assets.

Bit Digital operates a large-scale digital asset mining business with over 50,000 specialized computers across multiple locations. The firm is aiming to significantly expand its mining fleet by the end of 2024, which would approximately double its current capacity.

In parallel, Bit Digital is converting some of its mined Bitcoin (BTCUSDT) into Ethereum (ETHUSDT). This approach allows the company to stake ETH, generating higher yields and creating another steady revenue stream.

Beyond digital asset mining, Bit Digital has ventured into the AI space with Bit Digital AI, providing infrastructure to support generative AI workflows. Bit Digital’s HPC division has quickly become a significant revenue driver. In the second quarter of 2024 (the first full quarter of operations for this segment), the HPC segment generated $12.5 million in revenue and a gross margin of 63%.

The company also signed an agreement with Boosteroid, a leading cloud gaming provider. This partnership opens up new growth avenues for Bit Digital’s HPC services, expanding beyond AI and large language model (LLM) training. Bit Digital AI is rapidly growing, and the company aims to achieve $100 million in annualized AI revenue by the end of 2024, driven by customer growth and increased business from current clients.

The company’s financial position remains strong. The firm has a zero debt balance sheet and no unfunded purchase obligations, giving it the flexibility to capitalize on growth opportunities.

Wall Street analysts are optimistic about Bit Digital’s future. The company has earned a “Strong Buy” consensus rating, with a price target of $5.58, representing a potential upside of about 68% from its current stock price.

Penny Stock No. 2: Altus Power AMPS

Altus Power AMPS is a compelling penny stock to gain exposure to the high-growth clean energy space. Specializing in commercial and industrial solar power, the company is well-positioned to benefit from the accelerating demand for renewable energy solutions, thanks to its solid business model, strong fundamentals, and a favorable sector outlook.

The company benefits from its solid portfolio of 990 megawatts of solar photovoltaic (PV) capacity. Additionally, Altus Power has secured long-term power purchase agreements (PPAs) with over 450 enterprise clients and serves more than 25,000 residential customers through 290 MW of community solar projects. Its diversified client base and PPAs provide stability and recurring revenue streams.

Altus Power is focusing on both expanding its footprint and improving operational efficiency. Its growing scale and diversification help the company access capital at competitive rates, enabling further expansion. As the company grows, it’s also becoming more efficient in managing its operations, driving improvements in profitability.

Despite some short-term headwinds that led to a dip in stock performance year-to-date, Altus Power remains committed to its long-term goals. The company reaffirmed its three-year guidance, projecting a CAGR of 20% to 30% in megawatt capacity, signaling accelerating growth in the quarters ahead.

Altus Power focuses on building a leaner, more profitable business by improving revenues and enhancing operational efficiency. The company is also streamlining its operations by deprioritizing non-core activities, ensuring that resources are allocated toward high-growth areas.

In addition to organic growth, Altus Power focuses on acquiring assets that enhance its market position. These acquisitions are expected to provide attractive returns and further strengthen the company’s foothold in the renewable energy sector.

Analysts have given Altus Power stock a “Strong Buy” consensus rating.

The average price target of $5.83 suggests a 78.3% upside potential from current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Read More: 2 ‘Strong Buy’ Penny Stocks With At Least 68% Upside Potential — TradingView News