Illustration: Liu Xidan/GT

Even as the US economy stumbles due to inflation and regulatory burdens, American lawmakers can’t help but get caught in shady stock market deals. Just last week, a Democrat representative from Massachusetts violated a 2012 law that merely requires members of Congress to report their stock trades in a timely manner. According to Business Insider, Bill Keating traded up to $15,000 worth of shares of one budget clothing chain for another but reported it after the 45-day deadline mandated by the Stop Trading on Congressional Knowledge (STOCK) Act, a 2012 bill intended to curb unethical market behavior.

Keating’s office said the trades were made by an investment firm and that the House Ethics Committee forgave the transgression since the delay was within their grace period. The congressman didn’t even have to pay a $200 fine, and odds heavily favor his re-election in the midterms. Two other Massachusetts Democrats in the House have also violated the STOCK Act, according to Business Insider. In fact, a total of 73 lawmakers have, since the outlet started tracking their transgressions in 2021.

The problem with lawmakers trading stocks is that they are also responsible for passing laws that affect the markets, in a clear case of a conflict of interest that often opens them up to accusations of “insider trading.” American law enforcement frowns on the notion of people acting on knowledge not available to the general public, and private citizens can land in a world of hurt if so much as suspected of it. Famous homemaker Martha Stewart actually spent several months in federal prison back in the 2000s, just on process charges of “obstruction” and “false statements” during the investigation into potential insider trading, though she was never charged with it.

House Speaker Nancy Pelosi, a California Democrat, loves to say “no one is above the law” when it comes to prosecuting Republicans or former president Donald Trump – but she and her fellow lawmakers are definitely a different category when it comes to things like insider trading.

It was the uncanny over-performance of Pelosi’s own stock portfolio that drew attention to potential insider trading by Congress, back in 2021. An anonymous Twitter account named “Nancy Pelosi’s Portfolio Tracker” attracted over 200,000 followers before it was banned without explanation in early December. With a congressional salary of $223,500 a year, she was somehow worth an estimated at $120 million. Confronted about her seemingly uncanny business sense that month, Pelosi argued the US has a free-market economy and that members of Congress “should be able to participate” in.

Moreover, she said, it was her husband Paul – in the headlines recently for different reasons – who was handling all the stock trades in the family, and she knew nothing about it whatsoever. President Joe Biden said much the same thing when asked about the business dealings of his son Hunter. The American press took them both at their word and probed no further.

Pelosi had a sudden change of heart in January this year, suddenly announcing she would be fine with an insider trading ban but insisting it had to include the US Supreme Court, without elaborating as to why. Right on cue, the media announced that two recently elected Democrat senators -Jon Ossoff of Georgia and Mark Kelly of Arizona – had introduced a bill that would require lawmakers and their family members to sell off their stocks or put them in a blind trust while in office. Yet the bill then quietly died in committee, even though Democrats have the required majority in both the House and the Senate. The House finally unveiled its own proposal in September, which was criticized for being too broad and full of loopholes – only to shelve it until after the midterms.

To be entirely fair, one needs to point out that Democrats aren’t the only ones dabbling in what could be unethical trading. Several Republicans outperformed Pelosi’s stock portfolio in 2021, according to the watchdog Unusual Whales. Among them is Congressman Dan Crenshaw of Texas, who was elected as an independent-thinking military veteran but quickly became yet another voice of the permanent Washington establishment. Whether that is somehow related to his newfound business acumen is anybody’s guess.

Another establishment Republican, Senator Richard Burr of North Carolina, actually stepped down as head of the Intelligence Committee in May 2020 and decided not to run for re-election this year, after getting accused of insider trading – even though the probe against him was closed in January 2021, without any charges.

Members of the US Congress routinely engage in behavior that would get their colleagues in countries Washington disapproves instantly accused of corruption and placed on a sanctions list. Between the internalized belief in American exceptionalism – “it’s different when we do it” – and US law enforcement becoming influenced by party politics, few get called on it.

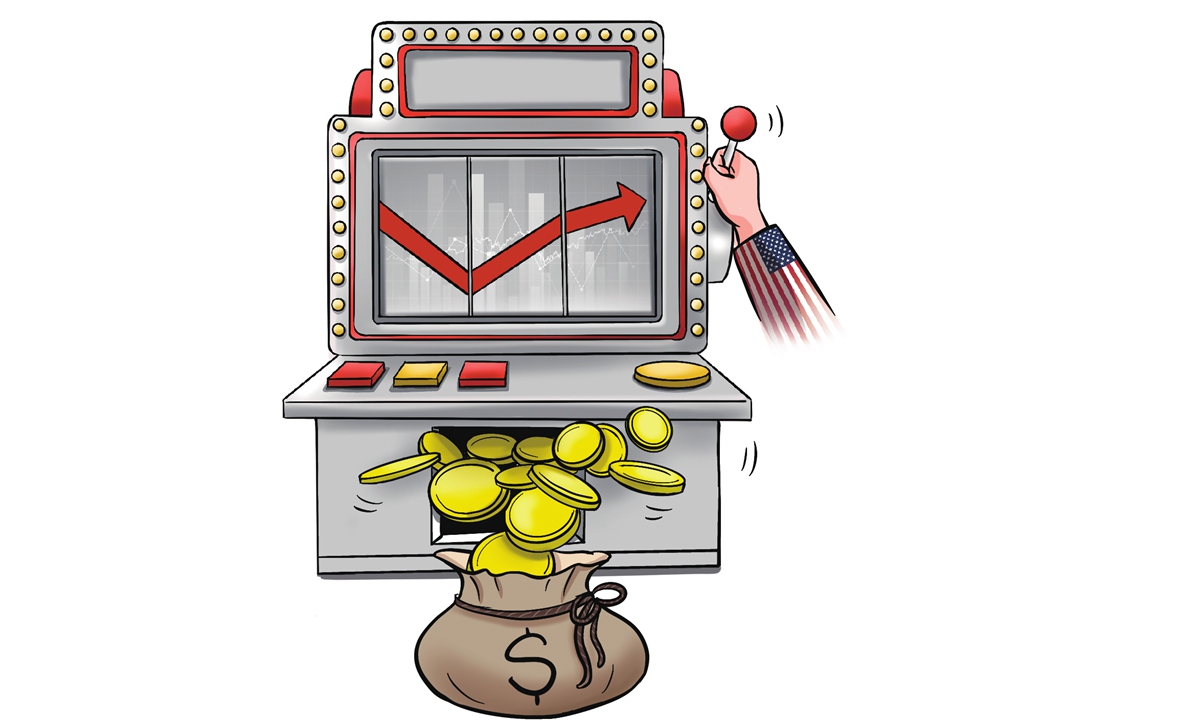

“Power tends to corrupt and absolute power corrupts absolutely,” Lord Acton famously wrote centuries ago. American lawmakers certainly have a lot of power. Meanwhile, the financialization of Western economies has turned the American stock exchanges into the equivalent of Las Vegas casinos. What’s important to remember about a casino is that “the house always wins.” When one literally runs the house (or the House, as the case may be), the temptation is simply too great. Until that temptation is somehow removed, it won’t matter how many “better” politicians get elected or how many new – but easily flouted – rules get passed.

The author is a Serbian-American journalist. opinion@globaltimes.com.cn

Read More: The House always wins: A tale of politicians and insider trading