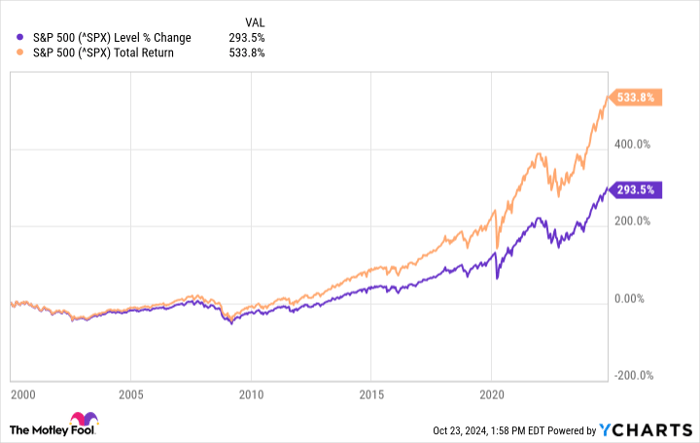

Everyone loves the concept of passive income. Nothing beats getting paid without lifting a finger. Dividends can be a great source of passive income, but those who decide to reinvest the payouts are engaging in what might be called passive investing. It’s a compelling strategy: Strategically reinvesting dividends improves long-term returns. Just check the performance of the S&P 500 since 2000, without and with dividends reinvested.

Choosing a random dividend stock out of a hat won’t do, though. Some are much more attractive than others. Which ones should investors pick? Let’s consider two income stocks that look like excellent forever investments: Visa (NYSE: V) and Amgen (NASDAQ: AMGN).

1. Visa

Visa is one of those companies whose business everyone knows about but few bother to try to understand. No one thinks through the process that occurs when they swipe (or tap) their credit or debit card at a terminal. Visa, a leading payment processing company, allows these transactions to flow smoothly thanks to its payment network, which connects merchants and the banks that issue the cards. There are several reasons Visa’s business model is excellent.

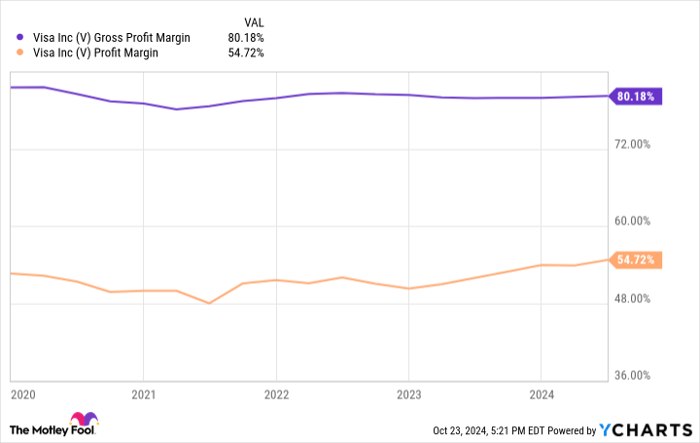

First, since it does not issue the cards or extend loans itself, Visa isn’t subject to credit risk. Second, the company pockets a fee for every transaction, of which there are millions daily. Third, Visa has already done the expensive work of setting up its payment network. The company has high gross and net margins because additional transactions add little to its operating costs.

V Gross Profit Margin data by YCharts

Fourth, Visa benefits from a competitive advantage from at least two sources: the network effect and a strong brand name. The more merchants accept Visa as a payment method, the more attractive the company’s network is to customers. It works the other way around, too. Hence, the value of Visa’s platform increases with use. Visa’s network effect is a crucial reason it has few competitors. It practically shares a duopoly with Mastercard.

This is also why wrestling customers and merchants away from the company is challenging. So, Visa’s future looks bright, especially since it has plenty of room to grow. Though card transactions seem ubiquitous, cash and check payments aren’t dead, especially in developing countries. Visa’s worldwide reach should allow it to perform well as it captures an ever-increasing share of the global payments market. That formula is a reason for its past success.

V Revenue (Annual) data by YCharts

Visa’s dividends have increased by 333% during the past decade. Its 0.7% forward yield might be below the S&P 500’s average of 1.3%, but its cash payout ratio, just under 22%, shows it can sustain plenty more dividend hikes. Visa’s strong business, consistent financial results, and payout growth should appeal to long-term investors.

2. Amgen

Amgen is a leading drugmaker — a business that won’t go out of style soon unless scientists discover some magical cure-all. Because that’s so unlikely, Amgen is in a great position, and that makes it a forever stock. The company has a long track record of innovation, an essential quality for drugmakers. Its current portfolio of more than two-dozen medicines boasts several that generate more than $1 billion in annual sales.

Amgen also continues to strengthen its lineup and pipeline, whether through internal development of new drugs or acquisitions. Last year, it bought Horizon Therapeutics for about $28 billion, allowing the biotech giant to get its hands on Tepezza, the only therapy for thyroid eye disease approved by the U.S. Food and Drug Administration.

Amgen has been expanding Tepezza’s reach in ways that would be difficult for a smaller drugmaker — like the former Horizon Therapeutics — that has much less funding. Amgen’s marketing efforts and its work toward regulatory approvals in many other countries should allow the medicine to hit its stride. Elsewhere, the biotech is developing new compounds, including a highly promising weight loss medicine called MariTide. In the universe of weight loss therapies in development in the industry, this one has grabbed plenty of attention.

That’s good news for Amgen. Developing novel medicines is an expensive, risky, and lengthy process. However, Amgen’s deep pockets, industry experience, and innovative culture should allow it to be successful in the long run. The company’s performance — and dividend growth — have been solid.

AMGN Revenue (Annual) data by YCharts

Amgen’s forward yield is almost 2.9%. Its cash payout ratio looks a little high at 86%. We can blame its recent major acquisition for that. However, the company’s capital allocation priorities seem clear from the fact that it raised its dividend this year despite splurging on an acquisition in 2023. In other words, Amgen should continue rewarding its shareholders this way for a long time.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,991!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,618!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,922!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool recommends Amgen and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Read More: 2 Reliable Dividend Stocks You Can Buy and Hold Forever