Investment companies | Monthly | December 2022

A collation of recent insights on markets and economies taken from the comments made by chairs and investment managers of investment companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Federal Reserve Bank of San Francisco president Mary C Daly: “I can’t iterate enough that one month of data, positive data on inflation does not a victory make. And 7.7 is not price stability.”

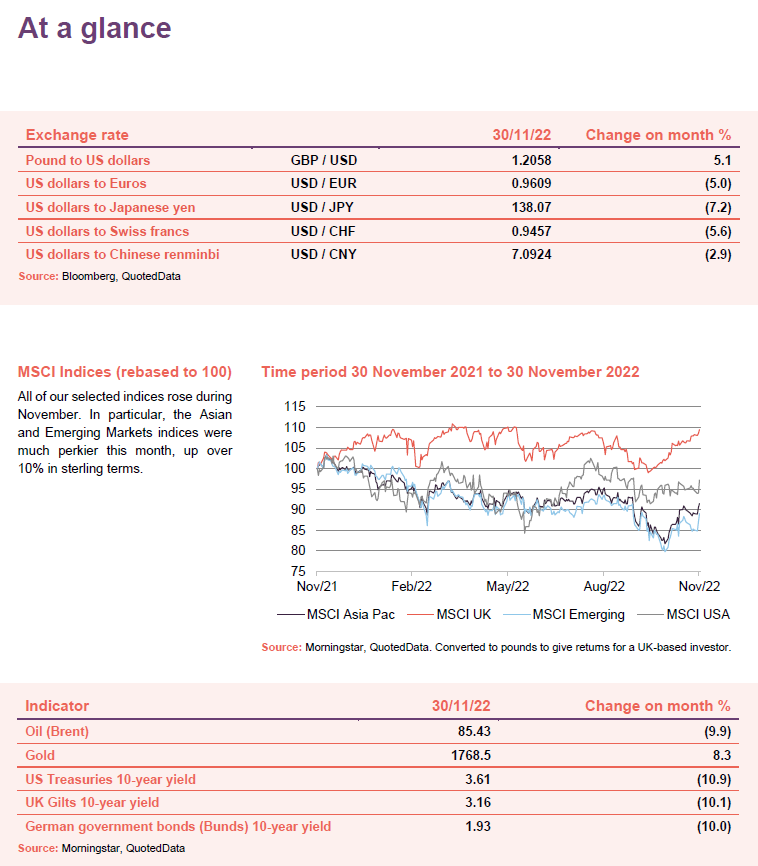

The annual US consumer price inflation figure for October came in at 7.7%, less than the 8.0% that had been forecast. This raised hopes that US interest rate hikes would ease. Equity markets embraced the news, bond yields fell and so too did the US dollar.

The Democrats did better than expected in the US mid-term elections, holding onto control of Congress. In Ukraine, Russia retreated from Kherson and switched its efforts to destroying Ukraine’s infrastructure. COP27 secured a promise that richer nations would help vulnerable ones adapt to climate change, but there was little progress on tougher emissions targets.

China’s zero-COVID policy has been weighing on that market and stirring up unrest within the country as rising cases triggered renewed lockdowns. November’s surprise was some relaxation of the policy, which helped to propel Chinese markets higher. However, given poor vaccination rates/vaccine efficacy, we may yet see another U-turn in this area.

Talking of U-turns, the UK Chancellor’s autumn statement saw some clarification of the windfall tax on renewable energy generators. In the event, the impact was less than feared, and subsequent net asset value

” class=”glossary_term”NAV announcements in the sector have been positive.

Global

(compare global funds here)

Managers, JPMorgan Global Core Real Assets – 29 November 2022

Even as interest rates have risen, there are expectations for further increases later this year, although the pace of the increase is likely to be less steep than originally thought. Inflationary pressures remain the primary driver for these expectations, with inflation up to 8-10% across Europe and the U.S. and the UK seeing even higher rates. A good proportion of the increase in prices has been due to changes in energy and commodity markets. The U.S. has provided some mitigation to this through an increase in crude oil production and the release of strategic reserves, but unfortunately the same levers are not available to the U.K. and Europe.

On entering a downturn, eyes naturally shift to the U.S. housing market where the fixed rate for mortgages has already risen from below 3% to above 6%. However, while the number of housing transactions, and the associated economic activity, will likely continue to slow, it appears improbable that we will see a repeat of the 2008 housing-led financial crisis. This is because 95% of American mortgages today are on long-term fixed rates, compared with only 80% in 2007. As a result, there should be fewer forced sellers as a result of interest rate rises. There has also been much less sub-prime lending, and the banks are now better capitalised, which means they are better able to withstand loan losses that might be seen in a recession.

On a more positive note, the West has adapted well to ‘living with Covid’. Less so, however, in China, with a smaller degree of infection-induced immunity and lower vaccine take-up among the elderly, meaning that various forms of restrictions continue to be imposed by the Chinese Government in a continuing attempt the quash the virus. Given that China accounts for between a third and a half of all global growth, these restrictions have wide economic consequences, including an impact on the transportation market.

Our view is that fiscal support and more gradual central bank tightening will help us avoid a severe global downturn. With major markets having already experienced double-digit declines, our central scenario does not point to significant further downside for assets. But this is a time for forecasters to be humble in their convictions; understanding the post-pandemic economy and unprecedented policy response further complicates the forecasting process. As investors, this translates into a need for well diversified, balanced portfolios and, very possibly, increased use of non-public market diversifiers such a real assets as a way to ensure robust assets of a fund such as an investment company, investment trust or OEIC.

” class=”glossary_term”portfolio outcomes.

. . . . . . . . . . .

Sebastian Lyon, manager, Personal Assets Trust – 20 November 2022

Over the past decade or more, investors have, often without realising it, gradually been increasing their risk. Yields on cash and Bonds and shares are usually considered more liquid than private equity and property. Some investments may be subject to a lock-up. In that regard, Liquidity is also applied to the buying or selling of the shares of investment companies.

” class=”glossary_term”liquidity had found its way into all the cracks. Stock markets have slowly and steadily become more expensive. That process, which has been in place since the Global Financial Crisis, is now in reverse. Inflation has been rising for the last 18 months and central banks have looked woefully behind the curve. Consequently, we are experiencing the fastest tightening of financial conditions since the Federal Reserve was established a century ago. This year the Fed has increased rates at a breathtaking pace, from near zero to 4%, while the Bank of England has followed to a more modest 3% base rate.

According to Warren Buffett, “Interest rates are to asset prices what gravity is to the apple.” Rising rates are now exposing the prevailing asset overvaluation. During 2022, we have experienced the deflation of a ‘bubble in everything’. Bubbles are notoriously difficult to recognise, in real time, but with hindsight we can see that the strong run in equites, immediately following the pandemic in 2020 and 2021, had similarities with the dotcom bubble of 1999. This time the market peaked with the enthusiasm for ‘meme stocks’ and unprofitable technology investments in the spring of 2021, and since then the bubble has been deflating.

The current bull market. Both bear and bull market spirals can become self sustaining. For example, in a bear market, falling confidence leads to selling, which leads to falling prices and losses, that can create further pessimism and further selling.

A bearish investor is one with a pessimistic outlook, while a bullish investor is one with an optimistic outlook.

” class=”glossary_term”bear market is similar, but not identical, to the three-year stock market fall from 2000-2003. In contrast to that period, there have been few attractive alternatives to protect and grow capital in 2022. Rising yields have hit bond markets equally hard. The Bloomberg US Long Treasury Bond Investment Managers as Benchmarks and by investors to compare performance.

” class=”glossary_term”Index has fallen over -34% this year, its worst year on record and a performance even worse than that of the Nasdaq. The US Dollar has been the only place to hide. Gold has also protected capital in most currencies including Sterling, Euro and Yen. With these notable exceptions there have been few ports in the storm of falling equity prices. Index-linked bonds, somewhat counterintuitively, have been dragged down with the wider bond market, as longer-term inflation expectations remain low. The UK’s unforced error of the ‘mini’ budget in September revealed a vulnerability in the portfolio structure of many of the country’s pension funds, exposing the gilt market to sharp falls and heightened Fiona McBain, chair, Scottish Mortgage – 10 November 2022

Long-term Value investing

Growth investing

” class=”glossary_term”growth investing is crucial for driving society forward. After a long period of global expansion, it’s easy to slip into the mindset that investors passively benefit from broader progress and economic growth. We believe causality flows in the other direction: long-term investment enables growth and progress. Technology and new ways of doing things aren’t adopted simply because their time has come. They happen because investors give entrepreneurs the financing and time to build their visions into reality.

Without investment in technology, infrastructure and entrepreneurship, it will be tough to dig ourselves out of our current malaise. If so little of aggregate savings are directed into ventures exploring new technologies and approaches, what does it imply for the future? We risk condemning ourselves to the environment of anaemic growth and stagnant wages that has characterised the United Kingdom over the past decade.

Financing the development of long-term growth companies is not what interests most investors. To understand that, you need only observe the commentary of recent months, focused on ‘risk off’, deleveraging and the flight to safety. The market’s focus has narrowed to a handful of economic variables. Stock prices react dramatically to each monthly update.

Powerful forces of change are creating significant opportunities. These include society’s transition away from carbon-fuelled transport and energy generation and the application of information technology to our understanding of the molecular basis of disease. While rising interest rates and increasing friction between the United States and China create a problematic environment to navigate, the long-term advantages of companies are often built in periods of stress and capital shortage.

. . . . . . . . . . .

Peter Spiller, Alastair Laing, Christopher Clothier, managers, Capital short-term liabilities) divided by net assets and expressed either as a percentage or as a number where 100 = no gearing and 110 = 10% gearing. NB if in doubt, it is recommended that the investor should check.

” class=”glossary_term”Gearing Trust – 11 November 2022

It is quite possible that we are close to a short-term peak in inflation, with many volatile components likely to pull headline inflation down over the coming months. These include food and energy, where costs remain high but have come down from their peaks earlier in the year. Many of the bottlenecks that had built up over the pandemic, such as in semiconductors and shipping, have eased or even gone into surplus. Interest rates are rising rapidly, causing demand to contract, and suggesting that the economic outlook is likely to be very weak.

All of this indicates that the headline RPI Index which the CPI replaced).

” class=”glossary_term”CPI figure will soon turn downwards. Indeed, the peak may already have passed in the US, where the September annualised inflation level was 8.3%, almost 1% lower than in June. However, in the same month core CPI (which strips out food and energy) continued to rise, hitting 6.6%, which is its highest level in 40 years. Wage growth is well established, underpinned by industrial action calling for higher settlements. Given these trends, it seems quite likely in the coming months that headline inflation will drop well below core CPI, giving the initial impression that inflation is under control, even though the underlying inflationary pressures in the economy remain strong. The impression of weakening inflation combined with a recessionary economic backdrop may give central banks cover to cut interest rates again at some point next year. The backdrop of falling short rates and volatile inflation which cycles above a higher average than has been normal over the last decade should be a good backdrop for index linked bonds. Interest rate volatility combined with a likely recession could well prove a headwind for equities.

. . . . . . . . . . .

UK

(compare UK funds here)

Jane Tufnell, chairman, Odyssean – 30 November 2022

Sentiment is erratic and there is immense pricing flux in many asset classes. The universe in which the Company invests, UK smaller companies, is seeing significant absolute value opportunities as well as relative and absolute mispricing.

UK equities, especially UK smaller companies with substantial overseas operations, look inexpensive, even taking into account the prospect of some earnings weakness. Whilst neither the Read our guide to Boards and Directors

” class=”glossary_term”Board nor the Portfolio Manager wishes to see the investment universe shrink further nor UK . . . . . . . . . . .

Stuart Widdowson, Ed Wielechowski, managers, Odyssean – 30 November 2022

At the time of preparation, there is considerable uncertainty in global and national financial markets, across many asset classes. There is a sense of foreboding that due to inflation, energy supply issues and rising interest rates, many countries are facing a recession. Individuals and corporates are experiencing rapid changes in interest rate expectations, driven by uncertainties in the bond market as central banks raise rates to attempt to control inflation.

We believe that UK equities are being de-rated more acutely than other equity markets due to a number of factors including, but not limited to, political instability, domestic economic concerns and UK equities continuing to become a smaller part of the MSCI Global indices. Over the past few weeks, the nature of selling has changed, with share price behaviours indicating more forced selling of shares, regardless of fundamentals. We believe that such conditions are consistent with the last phases of a bear market, typically leading up to some capitulation – either an event or series of events. Once markets reset, they begin to climb the “wall of worry”.

With markets difficult but inexpensive, our objective is to…

Read More: QuotedData’s Economic and Political Monthly Roundup December 2022