Global markets have shown mixed performance recently, with U.S. indices like the S&P 500 and Nasdaq Composite experiencing gains, driven by sectors such as utilities and real estate, while energy stocks faced declines due to easing geopolitical tensions. Amid these market dynamics, investors often look beyond large-cap stocks to explore opportunities in smaller companies that might offer growth potential at lower price points. Penny stocks, a term that may seem outdated but still holds relevance today, represent these underappreciated opportunities. In this article, we spotlight three penny stocks that demonstrate strong financials and the potential for significant returns in today’s market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.59 | MYR2.93B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.75 | MYR129.91M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.30 | CN¥2.11B | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.6M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.235 | £302.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.065 | £404.29M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,804 stocks from our Penny Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Hongdou Industrial Co., LTD is a company that manufactures and sells clothing products, with a market cap of CN¥5.30 billion.

Operations: The company’s revenue is primarily derived from the domestic market, generating CN¥2.11 billion, with an additional CN¥170.50 million from exports.

Market Cap: CN¥5.3B

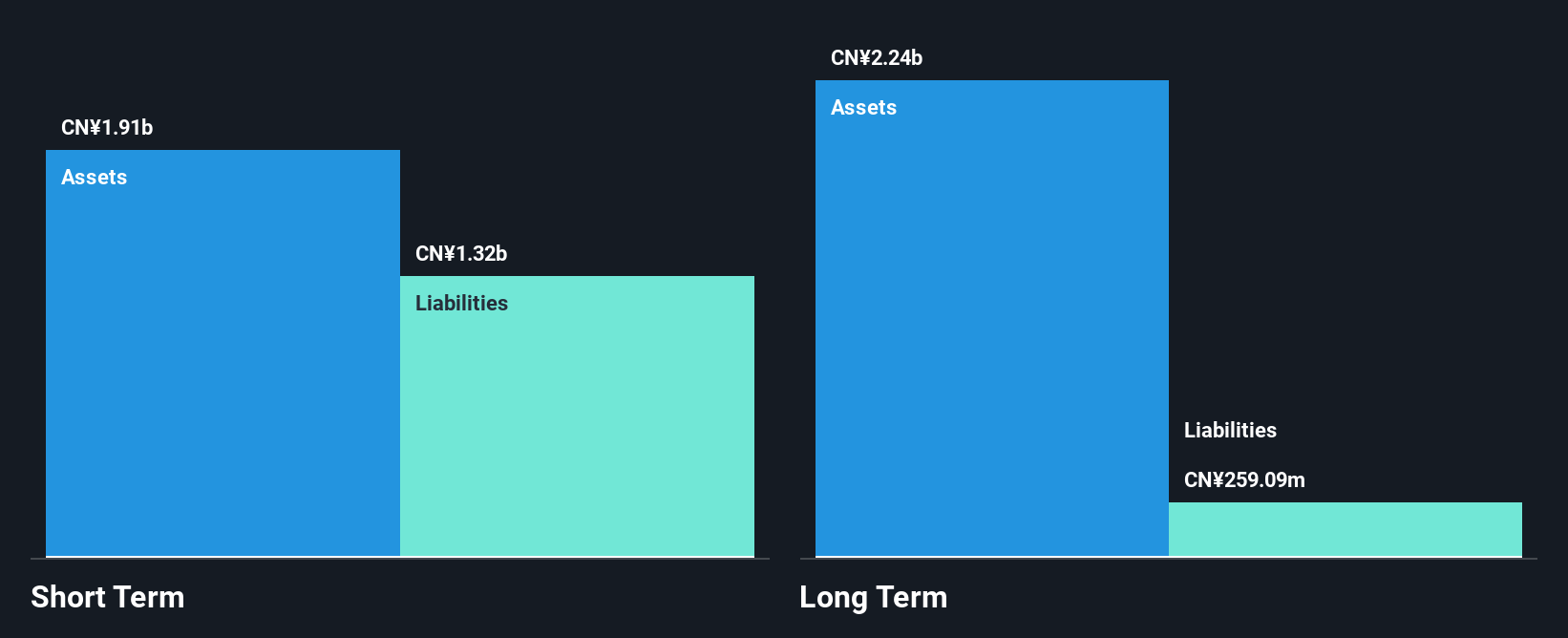

Jiangsu Hongdou Industrial Co., LTD, with a market cap of CN¥5.30 billion, has shown significant earnings growth of 165.7% over the past year despite a decline in profits over the last five years. The company’s short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management. However, its Return on Equity is low at 0.9%, and its dividend yield of 0.87% is not well covered by earnings. Recent buyback activities have slightly reduced share count, reflecting management’s confidence in undervaluation as shares trade below estimated fair value by 44%.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Jingxing Paper Joint Stock Co., Ltd. operates in the paper manufacturing industry and has a market cap of CN¥3.77 billion.

Operations: The company generates revenue primarily from its papermaking segment, totaling CN¥5.42 billion.

Market Cap: CN¥3.77B

Zhejiang Jingxing Paper, with a market cap of CN¥3.77 billion, has experienced substantial earnings growth of 211.5% over the past year, though it faced a decline averaging 15.1% annually over five years. The company’s short-term assets significantly exceed both its short-term and long-term liabilities, demonstrating strong liquidity management. Despite this, its Return on Equity remains low at 1.9%. Recent share buybacks suggest management’s confidence in the company’s value as they repurchased shares worth CN¥32.49 million under a buyback program initiated earlier this year. However, negative operating cash flow indicates challenges in covering debt obligations effectively.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Yabo Technology Co., Ltd specializes in the design, research, and development of new materials for metal roof and wall enclosure systems, with a market cap of CN¥2.26 billion.

Operations: The company’s revenue is primarily derived from its Metal Roofing segment, which generated CN¥518.86 million, complemented by contributions from its New Energy Business at CN¥10.32 million and Software and Design at CN¥2.86 million.

Market Cap: CN¥2.26B

Shandong Yabo Technology, with a market cap of CN¥2.26 billion, primarily generates revenue from its Metal Roofing segment, reporting sales of CN¥120.62 million for the first half of 2024, down from CN¥230.81 million the previous year. Despite reducing its debt to equity ratio significantly over five years and maintaining satisfactory net debt levels at 12.4%, the company remains unprofitable with a net loss of CN¥45.07 million for the same period and a negative return on equity of -10.99%. It faces liquidity challenges with less than a year’s cash runway based on current free cash flow trends.

Turning Ideas Into Actions

- Reveal the 5,804 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St’s portfolio to get a 360-degree view on how they’re shaping up.

- Discover a world of investment opportunities with Simply Wall St’s free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Read More: Spotlight On 3 Penny Stocks With Market Caps As Low As US$300M