(Please enjoy this updated version of my weekly commentary published November 7th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

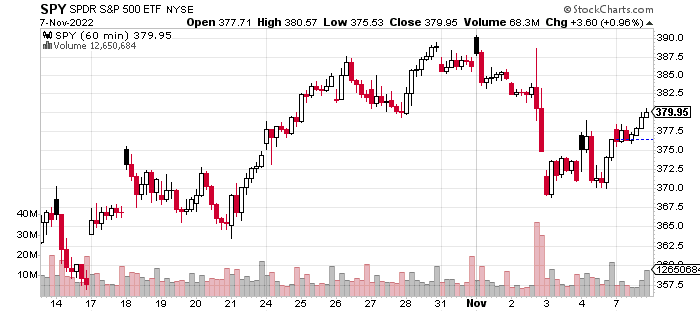

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is down by a bit more than 1.5%. It’s a big reversal from the ‘bear market rally’ which saw the indices climb by nearly 10%. As of today’s close, about 25% of the advance has been retraced.

The rally was driven by hopes of a Fed pause or slowing in the pace of hikes. The market got this as there were some hints that a slowing could be imminent, but stocks crumbled anyways following the FOMC meeting as Chair Powell reiterated his hawkish message.

The other big ‘event’ was the October jobs report on Friday. This came in better than expectations at 265,000 vs 205,000. Overall, it continued to be in line with other measures showing that job growth is positive but slowing. Albeit slowing at a much slower pace than seemed likely a few months ago.

There was nothing in the report that would indicate any sort of change in Fed policy and given that Fed policy is so hawkish, in my opinion, it further confirmed our bearish thesis.

Choppy Action

Despite this, stocks rose on the day and continued their advance on Monday. This is due to two bullish short-term catalysts.

One is the increased rumors and chatter that China is on the verge of re-opening its economy. This has led to strength in Chinese stocks, metals, energy, industrials, and other stocks that would benefit from the Chinese economy returning to full capacity.

Of course, there was immediate pushback to these rumors, and no one is certain whether there will be an actual change in policy. However, it makes sense that this would come about soon after the re-election of President Xi.

The other bullish catalyst is expectations of Republicans taking control of Congress. In fact, it could be possibly priced into the stock market (SPY) at this point, leading to a ‘sell the news’ type of event.

Given this mix of shorter-term, bullish impulses amid a bearish backdrop and a still powerful headwind of rising rates, I’m expecting choppy action in the short-term but expecting lower lows in price at some point in Q4.

Strategy

In terms of our strategy, I believe we are in a pretty good place with a mix of lower-volatility holdings in pharma and aerospace & defense in addition to other stocks which were selected due to being less affected by economic or monetary factors.

Our large cash holding also allows us to take advantage of any opportunities that emerge.

In the near term, we are seeing strength in cyclical and Chinese stocks as they are quite oversold and cheap which makes them susceptible to the biggest bounces. But, I think these areas would be eventually dragged down if the economy continues to slow and tilts into a recession.

On a longer-term basis, we are in a bear market. And, there’s no good reason for it to expect to end until we get some sort of turnaround in the slowing economy/earnings picture, an actual pivot in Fed policy (not a slowing), or possibly some sort of climatic decline in financial markets.

But, the longer it lasts, the better the opportunities that will be available on the other side. Therefore, we will continue to do the work of identifying the best stocks and themes for the next bull market.

Looking Ahead

The next big event is the CPI report on Thursday. Currently, expectations are for a 7.9% increase which would be a slight deceleration from last month’s 8.2%.

Of course, Q3 earnings season is also wrapping up, and it looks like the S&P 500 will have 2.2% earnings growth which is better than 1% forecasts as we entered earnings season but off expectations of 10% growth a few months ago.

Again, the earnings/economy is slowing but still expanding. In normal circumstances, this is a positive but from a financial markets perspective, it simply means that there’s no reason for the Fed to ease off its current path of aggressive hikes.

So, in this specific circumstance, this combination of raging inflation and slowing but positive earnings/economic growth is very bearish for markets.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $382.10 per share on Tuesday afternoon, up $2.15 (+0.57%). Year-to-date, SPY has declined -18.62%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More…

More Resources for the Stocks in this Article

SPY: Choppy Market Action Ahead

(Please enjoy this updated version of my weekly commentary published November 7th, 2022 from the POWR Growth newsletter).

As usual, we will start by reviewing the past week…

Here is an hourly, 3-week chart of the S&P 500 (SPY):

Over the last week, the S&P 500 is down by a bit more than 1.5%. It’s a big reversal from the ‘bear market rally’ which saw the indices climb by nearly 10%. As of today’s close, about 25% of the advance has been retraced.

The rally was driven by hopes of a Fed pause or slowing in the pace of hikes. The market got this as there were some hints that a slowing could be imminent, but stocks crumbled anyways following the FOMC meeting as Chair Powell reiterated his hawkish message.

The other big ‘event’ was the October jobs report on Friday. This came in better than expectations at 265,000 vs 205,000. Overall, it continued to be in line with other measures showing that job growth is positive but slowing. Albeit slowing at a much slower pace than seemed likely a few months ago.

There was nothing in the report that would indicate any sort of change in Fed policy and given that Fed policy is so hawkish, in my opinion, it further confirmed our bearish thesis.

Choppy Action

Despite this, stocks rose on the day and continued their advance on Monday. This is due to two bullish short-term catalysts.

One is the increased rumors and chatter that China is on the verge of re-opening its economy. This has led to strength in Chinese stocks, metals, energy, industrials, and other stocks that would benefit from the Chinese economy returning to full capacity.

Of course, there was immediate pushback to these rumors, and no one is certain whether there will be an actual change in policy. However, it makes sense that this would come about soon after the re-election of President Xi.

The other bullish catalyst is expectations of Republicans taking control of Congress. In fact, it could be possibly priced into the stock market (SPY) at this point, leading to a ‘sell the news’ type of event.

Given this mix of shorter-term, bullish impulses amid a bearish backdrop and a still powerful headwind of rising rates, I’m expecting choppy action in the short-term but expecting lower lows in price at some point in Q4.

Strategy

In terms of our strategy, I believe we are in a pretty good place with a mix of lower-volatility holdings in pharma and aerospace & defense in addition to other stocks which were selected due to being less affected by economic or monetary factors.

Our large cash holding also allows us to take advantage of any opportunities that emerge.

In the near term, we are seeing strength in cyclical and Chinese stocks as they are quite oversold and cheap which makes them susceptible to the biggest bounces. But, I think these areas would be eventually dragged down if the economy continues to slow and tilts into a recession.

On a longer-term basis, we are in a bear market. And, there’s no good reason for it to expect to end until we get some sort of turnaround in the slowing economy/earnings picture, an actual pivot in Fed policy (not a slowing), or possibly some sort of climatic decline in financial markets.

But, the longer it lasts, the better the opportunities that will be available on the other side. Therefore, we will continue to do the work of identifying the best stocks and themes for the next bull market.

Looking Ahead

The next big event is the CPI report on Thursday. Currently, expectations are for a 7.9% increase which would be a slight deceleration from last month’s 8.2%.

Of course, Q3 earnings season is also wrapping up, and it looks like the S&P 500 will have 2.2% earnings growth which is better than 1% forecasts as we entered earnings season but off expectations of 10% growth a few months ago.

Again, the earnings/economy is slowing but still expanding. In normal circumstances, this is a positive but from a financial markets perspective, it simply means that there’s no reason for the Fed to ease off its current path of aggressive hikes.

So, in this specific circumstance, this combination of raging inflation and slowing but positive earnings/economic growth is very bearish for markets.

What To Do Next?

The POWR Growth portfolio was launched in April last year and since then has greatly outperformed just about every comparable index…including the S&P 500, Russell 2000 and Cathie Wood’s Ark Innovation ETF.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +49.10% annual returns. I then take the very best stocks from this strategy and tell you exactly what to buy & when to sell, so you can maximize your gains.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $382.10 per share on Tuesday afternoon, up $2.15 (+0.57%). Year-to-date, SPY has declined -18.62%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More…

More Resources for the Stocks in this Article

Read More: SPY: Choppy Market Action Ahead