U.S. markets were less sunny at close on Friday than in Asia, where stocks continued to rally on economic stimulus measures out of Beijing amid news that Japan’s former Defense Minister Shigeru Ishiba would become the country’s next prime minister. Still, all U.S. indexes were up from where they were five days ago as optimism on cooling inflation and consumer spending have portfolios on the move.

- S&P 500 Futures: 5,796.00 ⬇️ down 0.15%

- S&P 500: 5,738.17 ⬇️ down 0.13%

- Nasdaq Composite: 18,119.59 ⬇️ down 0.39%

- Dow Jones Industrial Average: 42,313.00 ⬆️ up 0.33%

- STOXX Europe 600: 528.08 ⬆️ up 0.47%

- Nikkei 225: 39,829.56 ⬆️ up 2.32%

- SSE Composite Index 3,087.53 ⬆️ up 2.88%

- Bitcoin: $65,671.70 ⬆️ up 0.78%

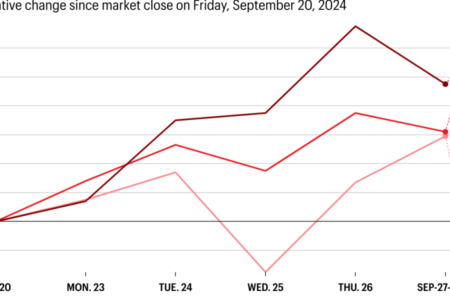

U.S. markets cool from mid-week highs

The Federal Reserve’s preferred measure of U.S. inflation was down more than expected Friday, at 2.2%, resulting in a boost for the Dow. Meanwhile, the Nasdaq and S&P 500 closed down from their highs earlier in the week.

The Dow, Nasdaq and S&P 500 rise

The Dow Jones Industrial Average closed up 0.33% Friday on Federal Reserve news about inflation as well as economic data showing strong sentiment among U.S. consumers. But the Nasdaq closed down 0.39% and the S&P 500 was down 0.13%, after hitting all-time-highs yesterday. Shares of Acadia Healthcare (ACHC) slid significantly Friday after the Justice Department announced that the company would pay nearly $20 million to settle allegations of improper billing. The company also broke the news to investors today that it was sent a request for information by the United States Attorney’s Office for the Southern District of New York and it received a grand jury subpoena from the U.S. District Court for the Western District of Missouri related to its admissions, length of stay and billing practices. Popular stock Nvidia was down 2.13% on Friday, while Rocket Lab USA Inc. climbed 12.54% following news it completed its second Pioneer spacecraft.

Europe: Luxury brands go jet setting

Hermès, Burberry and Kering were up, as China’s stimulus continued to fuel optimism in the ultra-luxury sector. LVMH patriarch Bernard Arnault was even catapulted back to his place as the world’s fourth richest man this week on the outlook for bougie brands. LVMH stocks were also up on Friday on the news that it was investing in the brand behind a viral TikTok ski jacket that sells for $2,000. The STOXX Europe 600 closed up 0.47% on Friday.

China: Week’s second stimulus shot boosts markets

China saw its best week in over 15 years on news of its economic stimulus, and despite trading glitches that caused early delays, the Shanghai Stock Exchange posted a 2.88% gain Friday. Hong Kong’s Hang Seng index surged 3.55%.

Japan: New PM announcement excites

Incoming prime minister Ishiba sent the Nikkei 225 rising 2.32%, aided by China optimism and dovish inflation numbers from Tokyo. The yen strengthened on the ruling party’s appointment of the former defense minister, who has been supportive of interest rate hikes, as the next PM.

Read More: Stock Markets Today: US markets cool from records