Alex Wong/Getty Images News

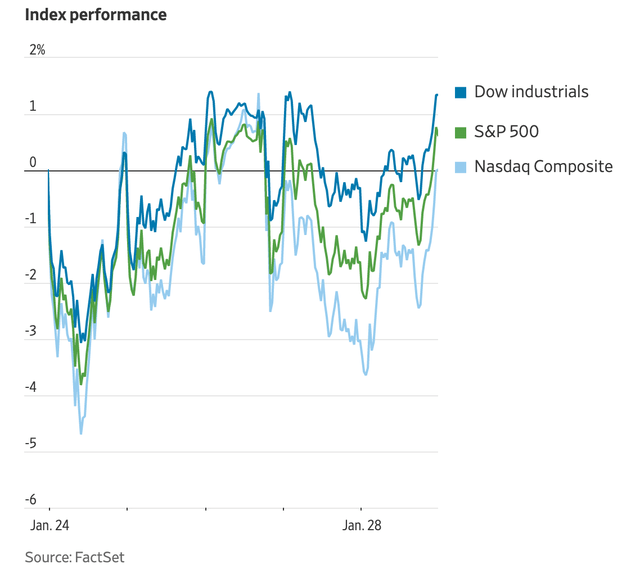

What can you say, the stock market closed up this past week.

Three of the five days, the stock market was below its close Friday, January 21.

But strong earnings reports led by Apple (NASDAQ:AAPL) helped investors “buy the dip” and give the stock market its first up week over the past four.

Stock Market performance

The S&P 500 Stock Index closed the week at 4,432, up from a week earlier close of 4,398, but below the previous market high of 4797 hit on January 3, 2022.

Federal Reserve

For most of the past week and the past month, the focus has been on the Federal Reserve and the monetary tightening that is being promised for the near future.

The thing is, the fact that the Federal Reserve is getting so much attention just points to the fact of how disjointed the whole world is right now.

Good central banking has always been associated with the fact that if the monetary authorities are really doing their job, no one talks about the central bank or about monetary policy.

Monetary policy only makes the news when the central bankers have created a situation that is problematic.

Well, this is where we are right now.

And, this is the financial environment we are left with.

Radical uncertainty.

No one seems to know where they are going.

Oh, yes, we have this person saying this and that person suggesting something else.

But one has to recognize the fact that there are many possibilities for the future that have not been identified. And that’s what makes the uncertainty, radical.

Just look at the performance of the stock market over the past week, over the past several weeks, and over the several months.

Market Much More Disrupted

Volatility has increased substantially.

Looking at a measure of volatility, the VIX index, we see that toward the end of this past week the index was over 31.00.

At the end of the previous week, the index was around 29.00.

At the first of the year, when the stock market was at a historical high, the index was around 16.50.

The volatility of the market rose as the uncertainty of what was going on also rose.

Again, the Federal Reserve is a major contributor to this uncertainty and is likely to be so for an extended period of time, given the way the current leadership is behaving.

“No More Mr. Niceguy!”

The picture that Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System, seems proud to take on his new persons:

No more mister niceguy!

The one group that really seems to appreciate this position are those people that work in the field of foreign exchange.

The value of the U.S. dollar has gotten a lot stronger with all this turmoil going on. Foreign exchange traders see Mr. Powell and the Federal Reserve “standing stronger.”

And, this is good for the U.S. dollar.

At the end of 2021, it cost someone just under $1.1400 to purchase one Euro.

The US Dollar Index (DYX) was around 95.50.

At the close of business on Friday, the Euro now cost about $1.1150 and the US Dollar Index dropped close to 97.00

Traders in foreign exchange are seeing the Fed sticking to its new stance, a position aimed at slowing down the inflationary pressures that appear to be present in the U.S. economy.

The Future

Two things appear to me to be certain in the very near future.

First, the Federal Reserve is going to start raising its policy rate of interest in March.

Second, inflation is going to continue to remain high for much of 2022.

Much else seems to fall into the category of possibilities.

Like, what is going to happen to about the spread of Copvid-19?

What is going to happen in Ukraine?

Are wage pressures going to rise in the labor market?

Are the supply chain problems going to be worked out?

Is the Republican party going to take over the U.S. Congress in the fall elections?

And, so on, and so forth.

One of the biggest uncertainties to me is how firm Mr. Powell and the Federal Reserve are going to be in this whole tightening process?

Since Mr. Powell has been the Chairman of the Board of Governors, he has always opted to err on the side of monetary ease.

It seems to me that Mr. Powell always wants to hedge his bets.

To me, this is not the attitude that a Chairman of the Board of Governors should have.

So, we will have to see how Mr. Powell is going to behave in 2022.

But, here we are talking about the future of the stock market and we turn to the Federal Reserve and how it might act over the next eleven months.

The best thing in the world for investors in the stock market would be to get to the time when the actions or potential actions of the Federal Reserve do not dominate the discussion.

Unfortunately, I don’t see this coming right around the corner.

Read More: The Stock Market Snaps 3-Week Losing Streak