This has been a wild and wooly couple of market weeks. First, the Fed held pat on interest rates. But after badgering Jay Powell with the same question asked in myriad ways, he eventually caved and essentially told listeners what they wanted to hear. The markets went BOOM. But my thought is a topping process is underway, advises Kelley Wright, editor of IQ Trends.

Indeed, when the employment report came out, the narrative changed so quick it made your head spin. The trap door to the downside opened up. That was facilitated by news from the Bank of Japan and the realization that the yen carry trade was coming to an end.

Now, we’re back on the Fed easing bandwagon, the BOJ folded like a cheap suit and recanted their change in their monetary policy, and KAZAM, all is well again.

(Editor’s Note: Kelley Wright is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

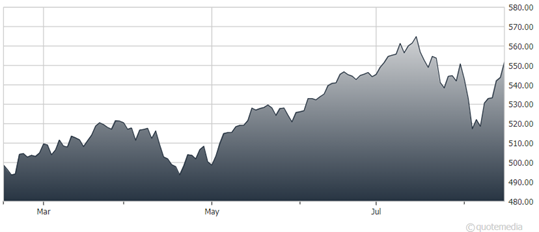

S&P 500 ETF Trust (SPY)

There has been a lot written and said about bull markets ending with a bang or a whimper. A study of market history reveals that typically the completion of a trend is a process, a series of fits and starts that takes investors one way, then the next.

Mr. Market is in the business of performing a “wallet-ectomy” on as many as possible as often as possible. Accordingly, this procedure is rarely tidy and neat. As I wrote in the Mid-July Investment Outlook, Rule #4 of 10 from the “Ten Market Rules to Remember” from Bob Farrell, the technical strategist legend at Mother Merrill, states that, “Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.”

My thought is the topping process is underway, and the reaction to the employment report and the change of policy by the BOJ is just the first salvo. It reveals that sentiment is capable of turning on a dime.

HOWEVER, do not assume the major indices have made their all-time highs. On a technical analysis basis, I am actually expecting them to take out their previous high-water marks. After that we’ll have to see. Whenever THE top is finally in, however, I suspect it will be a big bang.

Read More: Thoughts on Market Tops Amid Wild and Wooly Action