U.S. stocks ended higher Friday, with the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite each snapping two straight days of losses. Still, all three major benchmarks finished with weekly losses as investor worry about the Federal Reserve’s path of monetary tightening.

How stocks traded

-

The Dow Jones Industrial Average

DJIA,

rose 199.37 points, or 0.6%, to close at 33,745.69. -

The S&P 500

SPX,

gained 18.78 points, or 0.5%, to finish at 3,965.34. -

The Nasdaq Composite

COMP,

edged up 1.1 point, or less than 0.1%, to end at 11,146.06.

For the week, the Dow slipped less than 0.1%, while the S&P 500 shed 0.7% and the Nasdaq Composite fell 1.6%, according to FactSet data.

What drove markets

Sentiment in the U.S. stock market has weakened, with all three major benchmarks finishing Friday with weekly losses despite snapping back-to-back declines.

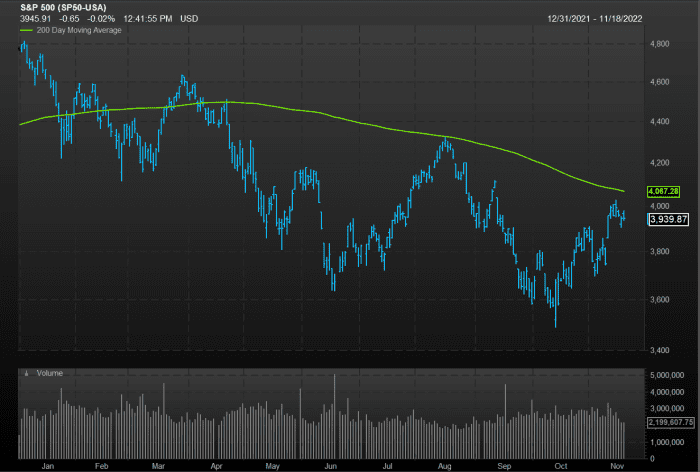

The rally that had been sparked by the consumer-price-index report on Nov. 10 lost steam as the S&P 500 rose back around its 200-day moving average, according to Anthony Saglimbene, chief market strategist at Ameriprise Financial.

“The market is having a hard time around this spot,” he said in a phone interview Friday. The 200-day moving average appears to be providing some technical “resistance.” FactSet data show that level at around 4,067 on Friday afternoon.

FACTSET DATA

In the wake of the CPI report showing signs of the cost of living easing, Federal Reserve Bank of Saint Louis President James Bullard said in a speech Thursday that the Fed will need to increase interest rates further to bring down inflation. He showed a chart indicating that the central bank’s benchmark rate could rise between 5% and 7%.

“It’s a very big range,” said Saglimbene. “If it’s 5%, the market will likely do pretty well,” as that’s “baked into” expectations, he said, but “if it’s 7%, the market is going to do very poorly.”

Today: MarketWatch Live Coverage

Andrew Hollenhorst, chief U.S. economist at Citi Research, was not surprised by Bullard’s remarks as his statement is supported by the data given that “the Atlanta Fed’s dashboard of underlying inflation metrics are all running above 4.7%, suggesting that policy rates will need to reach above 5% for real rates to be meaningfully positive.” That is a condition both Fed Chair Jerome Powell and Vice-Chair Lael Brainard have agreed on as a requirement for restrictive monetary policy, Hollenhorst said in a note on Friday.

In U.S. economic data, the National Association of Realtors said Friday that existing-home sales fell 5.9% in October, slumping for a ninth straight month. That’s down 28.4% from a year earlier.

Meanwhile, the U.S. leading economic index fell 0.8% in October, an eighth straight monthly decline, according to a Conference Board report Friday. That’s bigger than the 0.4% fall that economists polled by The Wall Street Journal had forecast.

“The downturn in the LEI reflects consumers’ worsening outlook amid high inflation and rising interest rates, as well as declining prospects for housing construction and manufacturing,” said Ataman Ozyildirim, senior director of economics at the Conference Board. “The Conference Board forecasts real GDP growth will be 1.8 percent year-over-year in 2022, and a recession is likely to start around year-end and last through mid-2023.”

With the housing market in a steepening slowdown and goods spending “contracting a bit,” Jim Baird, chief investment officer of Plante Moran Financial Advisors, said in a phone interview Friday that he’ll be watching for signs of weakening in the services sector.

“That’s where the rubber will meet the road next year, if we see continued deterioration there,” he said. That’s when the economy would probably tip into a recession, “if we get there.”

Meanwhile, high inflation remains a “challenge” and risks of a recession in 2023 have risen, said Baird. “It’s hard to paint an overly optimistic picture for equities in the near term.”

On Friday, $2.1 trillion of options expired, according to a Goldman Sachs report. That can create some market volatility, said Saglimbene.

Companies in focus

-

Gap Inc.

GPS,

shares rose 7.6% after the retailer swung to a surprise quarterly profit and reported sales above Wall Street’s expectations, saying it expects to better match inventory with demand by spring. -

Applied Materials Inc.

AMAT,

edged up 0.2% after reporting stronger-than-expected earnings and revenue. -

JD.com Inc.‘s

JD,

American depositary shares fell 2.5%, after the China-based e-commerce company reported third-quarter profit that nearly doubled to beat expectations by a wide margin. -

Coinbase Global Inc.

COIN,

shares dropped 7.2% after Bank of America downgraded Coinbase to neutral from buy, saying that the FTX debacle raises “contagion risk” for the crypto exchange platform, even if it is not another FTX.

—Steve Goldstein contributed to this article.

Read More: U.S. stocks finish up Friday to snap back-back losses, but still slide for the week