Goodfood Market Corp. (TSE:FOOD) stock has almost doubled in just the past three trading sessions, starting from C$0.36 on December 1 and closing at C$0.71 on December 6, hitting a high of C$0.83 earlier in the day. What caused this short squeeze? Its Fiscal Q4-2022 earnings report did because the company reaffirmed its expectation of being adjusted EBITDA and cash-flow profitable in the first half of Fiscal 2023.

Even though Goodfood’s earnings per share (EPS) missed analysts’ estimates by a wide margin and revenue came in line with expectations, the stock still squeezed much higher. A downgrade from successful RBC Capital analyst Paul Treiber couldn’t keep the stock down, either.

Goodfood’s Negatives Were Offset by Positives

In Fiscal Q4 2022, Goodfood’s revenue decreased by 37% year-over-year, coming in at about C$50 million. Also, its net loss increased from C$0.31 per share to C$0.78 per share, while analysts were expecting a C$0.10 per-share loss. Some things offset these poor numbers, however. C$46 million of the company’s net loss was due to a one-time expense as part of its return-to-profitability initiatives, which we discussed here. Next, Goodfood’s gross margin was 28.3% compared to 22.9% in the same period last year. Also, its adjusted EBITDA loss was just $2 million compared to $18 million last year.

Therefore, it seems like the company’s cost-saving initiatives are working. Goodfood expects positive adjusted EBITDA and cash flow in the first half of Fiscal 2023, with C$46 million to C$48 million in revenues in Q1 2023, along with a gross margin of 32% to 34%.

Is Goodfood a Good Stock to Buy, According to Analysts?

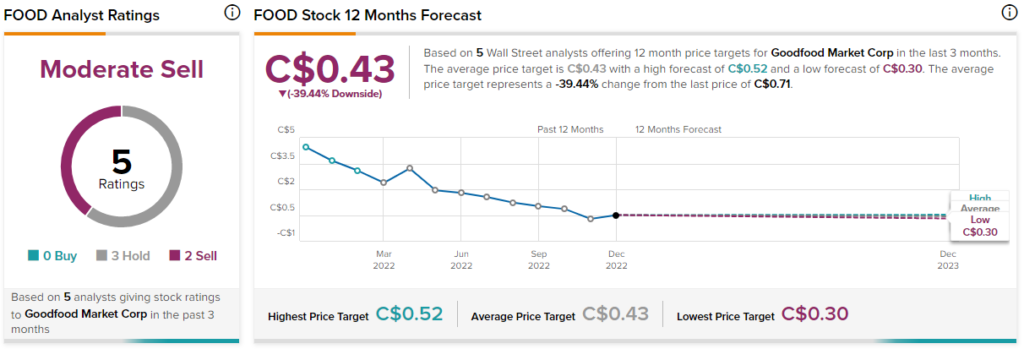

Despite the positive developments, analysts currently have a Moderate Sell consensus rating on FOOD stock. This is based on three Holds and two Sells assigned in the past three months. The average Goodfood stock price target of C$0.43 implies 39.4% downside potential.

Conclusion: Goodfood Could be a Major Turnaround Play

If Goodfood manages to reach cash-flow profitability within the next two quarters, the stock could continue much higher from here. Even after its rally, it’s down 85% in the past year alone, leaving it oversold. Investors may want to monitor Goodfood’s performance going forward for a potential turnaround play.

Read More: Goodfood Stock (TSE:FOOD) Doubled in 3 Days after This Critical Development