The Vanguard S&P 500 ETF (VOO 0.23%) is one of the largest exchange-traded funds (ETFs) by assets under management (AUM). The ETF had over $430 billion in AUM in mid-2024, ranking it the third-biggest ETF. The fund’s massive size, low cost, and focus have made it one of the most popular ETFs.

This guide will teach you everything you need to know about the Vanguard S&P 500 ETF and how to invest in ETFs for beginners.

What is it?

What Is the Vanguard S&P 500 ETF?

The Vanguard S&P 500 ETF is an ETF managed by The Vanguard Group, a large asset management firm owned by investors in its funds. The ETF invests in the same stocks as the S&P 500 Index, which represents the 500 largest publicly traded companies in the U.S. The fund aims to closely track the index’s returns, enabling fund investors to match the stock market’s average return.

While ETFs differ from mutual funds, Vanguard offers a similar mutual fund option: Vanguard 500 Index Fund Admiral Shares (NASDAQMUTFUND:VFIA.X).

How to buy

How to buy Vanguard S&P 500 ETF

It’s very easy to invest in the Vanguard S&P 500 ETF. You can buy shares directly from Vanguard or in your regular brokerage account. Here’s a step-by-step guide to buying shares of the ETF.

Step 1: Open an account

If you don’t already have an account (either a regular brokerage account or a Vanguard account), you’ll need to open one to buy shares of this ETF. It’s easy to open an account with Vanguard. It takes five to 10 minutes on their website. Once you open an account, you can choose any of their investment products, including the Vanguard S&P 500 ETF.

If you’d prefer to open a brokerage account instead of a Vanguard account, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you’ll need to determine a budget for how much money you want to invest. You’ll then want to figure out how to allocate that money. The Motley Fool’s investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. So, for example, if you have $10,000 to invest, you’d want to invest about $400 into each stock.

However, one of the Vanguard S&P 500 ETF’s great features is that it provides instant diversification. It holds shares of about 500 companies across all market sectors, so it’s one of the best long-term ETFs to invest in. You could buy this ETF and be completely diversified on day one. You can always add to your portfolio over time when you’re ready to purchase other ETFs or invest directly in individual stocks.

Step 3: Do your research

It’s essential to thoroughly research any investment before committing your hard-earned money. When analyzing an ETF like the Vanguard S&P 500 ETF, you should research similar funds and compare their strategies, expense ratios, and investment track records.

A percentage of mutual fund or ETF assets deducted annually to cover management, operational, and administrative costs.

Step 4: Place an order

Once you’ve opened and funded a brokerage account, set your investing budget, and researched the investment, it’s time to buy shares. The process is relatively straightforward. Go to your brokerage account’s order page or your Vanguard account and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (VOO for Vanguard S&P 500 ETF).

- Whether you want to place a limit order or a market order with your broker. (The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.)

Once you complete the order page, click to submit your trade to invest in the Vanguard S&P 500 ETF.

Its holdings

Holdings of Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF tracks the S&P 500. The broad market index holds roughly 500 of the largest publicly traded companies in the U.S. (it had 505 stocks in mid-2024). The index weighs its holdings based on their market caps. That means companies with larger market caps have a greater impact on the index.

As of mid-2024, the Vanguard S&P 500 ETF had 505 holdings. Its top 10 were:

- Microsoft (MSFT 0.03%): 7.1% of the fund’s holdings

- Apple (AAPL -0.08%): 5.6%

- Nvidia (NVDA 0.61%): 5.1%

- Amazon (AMZN 0.9%): 3.7%

- Meta Platforms (META 0.73%): 2.4%

- Alphabet Class A (GOOGL -0.04%): 2%

- Berkshire Hathaway Class B (BRK.B -0.62%): 1.7%

- Alphabet Class C (GOOG 0.03%): 1.7%

- Eli Lilly & Co. (LLY -1.32%): 1.4%

- Broadcom (AVGO -1.25%): 1.3%

Those 10 stocks make up almost one-third of this ETF’s assets. So, while it provides broad exposure to the country’s largest stocks, the biggest companies have a significant impact on its returns.

The Vanguard ETF, like the S&P 500, provides investors with diversified exposure to several stock market sectors. Its weighed sector exposure in mid-2024 was:

- Information technology: 29.6%

- Financials: 13.1%

- Health Care: 12.4%

- Consumer Discretionary: 10.3%

- Communication Services: 8.9%

- Industrials: 8.8%

- Consumer Staples: 6%

- Energy: 4%

- Materials: 2.4%

- Real Estate: 2.3%

- Utilities: 2.2%

Because it provides broad sector exposure, investors don’t need to invest in sector ETFs.

Should I invest?

Should I invest in Vanguard S&P 500 ETF?

Making any investment is a personal decision. You need to make sure it aligns with your goals, values, and risk tolerance. Here are some reasons you might want to invest in the Vanguard S&P 500 ETF:

- You’re seeking an investment that can deliver returns that roughly match those of the S&P 500 index.

- You want a low-cost passive investment.

- You understand that while the Vanguard S&P 500 ETF provides market returns, it also has market risk with volatility that will match the S&P 500.

- You’re seeking a diversified investment that provides broad exposure to the U.S. stock market.

On the other hand, here are some reasons the Vanguard S&P 500 ETF might not be right for you:

- You’re seeking investments that can deliver higher returns than the S&P 500.

- You’re a more risk-averse person and want an investment with lower volatility than the S&P 500.

- You’re at or nearing retirement and need more income than the Vanguard S&P 500 ETF can produce.

- You’re seeking an investment with less concentration among its top holdings.

Dividends

Does Vanguard S&P 500 ETF pay a dividend?

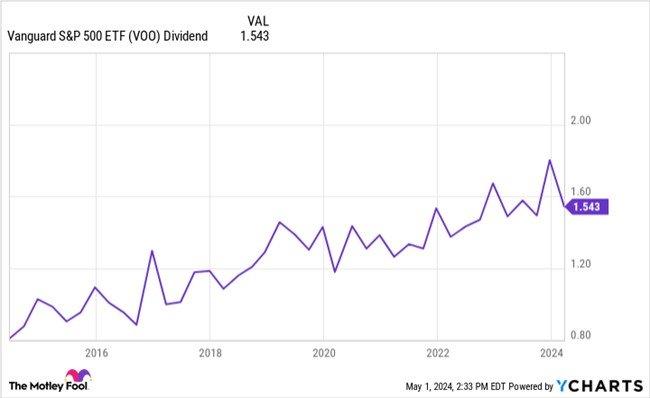

The Vanguard S&P 500 ETF paid a dividend of roughly 1.3% in mid-2024 (approximating the S&P 500’s dividend yield). The fund makes quarterly dividend income payments. While they will fluctuate from quarter to quarter based on the dividends received, payments have steadily risen over the years:

Image source: YCharts.

Although its low dividend yield might not make it one of the best dividend ETFs for income seekers, it does provide a market-matching and steadily rising dividend payment.

Expense ratio

What is Vanguard S&P 500 ETF’s expense ratio?

A low expense ratio is a hallmark of a Vanguard-managed fund. Since fund investors own the company, it can pass on its economies of scale and lower investment costs to them through a lower expense ratio, enabling fund investors to keep more of their returns.

Annual fee as a percentage of assets that an Exchange-Traded Fund charges investors for management and operational costs.

The Vanguard S&P 500 ETF has an ultra-low expense ratio of 0.03%, significantly below the average 0.79% expense ratio of similar funds. The low expense ratio enables investors to keep more of the fund’s return.

For example, the management fees charged by Vanguard on a $10,000 investment in the Vanguard S&P 500 ETF would be only $3 per year. For comparison, a similar $10,000 investment in a fund charging 0.79% would cost $79 per year. That higher cost would really add up over the years by eating into an investor’s returns.

Past performance

Historical performance of Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF’s goal is to closely track the average stock market return as measured by the S&P 500 index. It has delivered on its objective over the years:

|

Fund |

1-Year |

3-Year |

5-Year |

10-Year |

|---|---|---|---|---|

|

Vanguard S&P 500 ETF |

22.41% |

7.99% |

13.14% |

12.35% |

|

S&P 500 |

22.46% |

8.06% |

13.18% |

12.40% |

As that table shows, the fund’s returns have roughly matched those of the S&P 500 over the past one-, three-, five-, and 10-year periods. It has delivered a very slight underperformance due to its quite modest expense ratio. Its ability to deliver market-matching returns makes it one of the best ETFs to buy.

Related investing topics

The bottom line on Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF is one of the largest ETFs focused on delivering returns that match the S&P 500. It has done an excellent job over the years, largely thanks to its ultra-low expense ratio. It’s a great fund for investors seeking a low-cost way to earn market-matching returns. It can be a core piece of an investor’s portfolio.

FAQ

Investing in Vanguard S&P 500 ETF FAQ

How can I buy the Vanguard S&P 500 ETF?

You can buy the Vanguard S&P 500 ETF directly from Vanguard or through your regular brokerage account. Once you’ve opened an account with Vanguard to buy shares directly from the asset manager, the process takes about five to 10 minutes, and you can invest in any of their ETF products for as little as $1.

Meanwhile, investors with a brokerage account would follow these general steps to buy shares of the Vanguard S&P 500 ETF:

- Open up the order page.

- Fill out the order page, including:

- The number of shares you want to buy or the amount you want to invest in fractional shares.

- The correct ticker (VOO for Vanguard S&P 500 ETF).

- Market order or limit order.

- Double-check your order page and then submit your order.

Is Vanguard S&P 500 ETF good to invest in?

The Vanguard S&P 500 ETF is a very good investment. The ETF provides low-cost exposure to the S&P 500, a leading market index. It allows you to earn market-matching returns, which have averaged about 10% annually over the long term.

What is the ticker for the Vanguard S&P 500 ETF?

The Vanguard S&P 500 ETF trades under the stock ticker VOO.

What is the minimum investment for the Vanguard S&P 500 ETF?

The Vanguard S&P 500 ETF has a very low minimum investment of $1 if you purchase the ETF directly from Vanguard or through a brokerage account that allows the trading of fractional shares. If your broker doesn’t allow trading fractional shares, you’d need to buy at least one share (about $460 in mid-2024).

Read More: How to Buy Vanguard S&P 500 ETF (VOO)