Amid a backdrop of shifting global economic dynamics, the U.S. markets have shown resilience with notable advances in indices such as the S&P 500 and the Nasdaq Composite, driven by sectors like utilities and real estate. As investors navigate these evolving conditions, penny stocks—often seen as an investment avenue for smaller or newer companies—continue to draw interest for their potential to offer affordable entry points and growth opportunities. Despite being considered somewhat outdated terminology, penny stocks remain relevant today; when supported by strong financial health, they can present unique opportunities for significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,783 stocks from our Penny Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Financial Health Rating: ★★★★★★

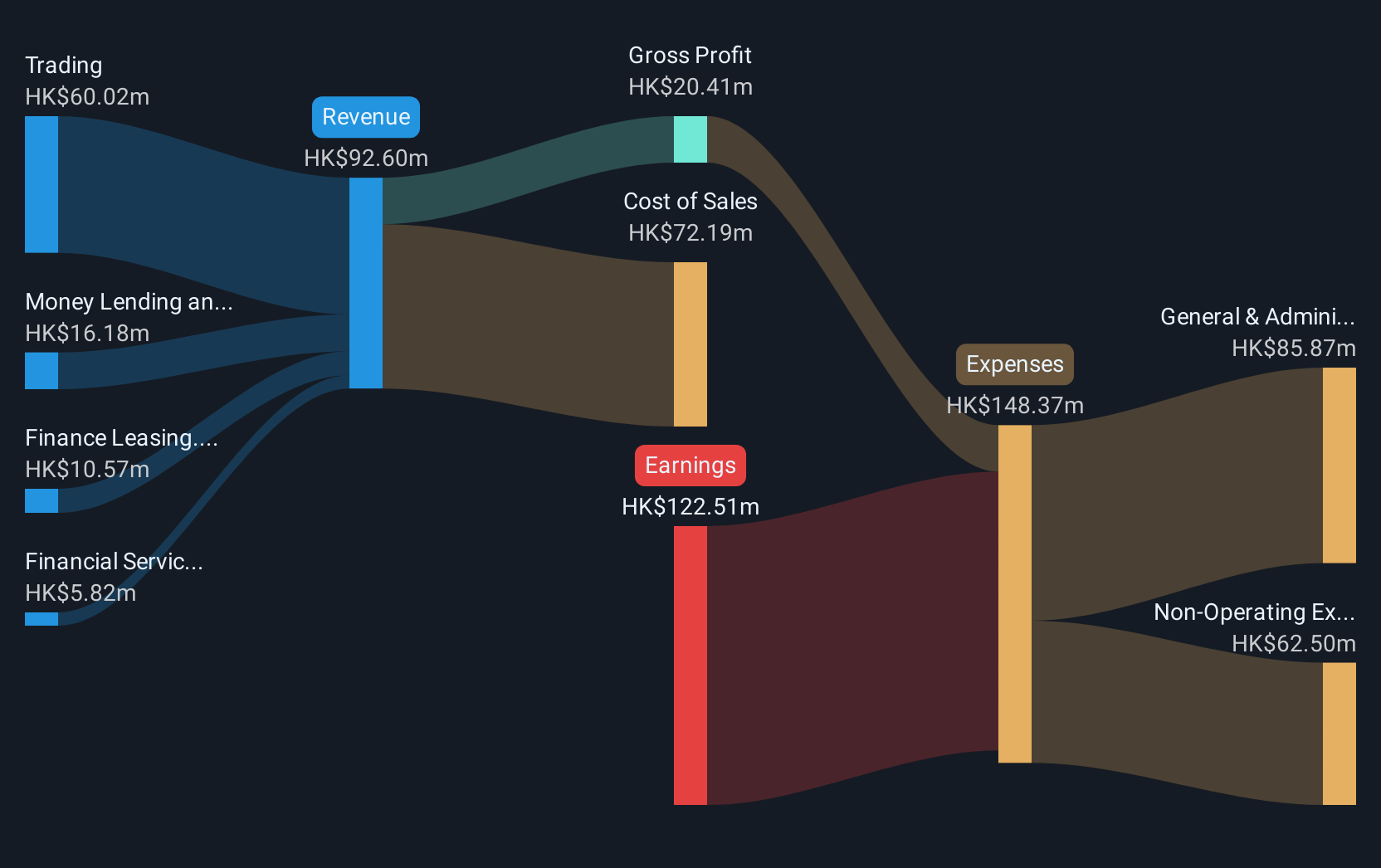

Overview: Hong Kong ChaoShang Group Limited is an investment holding company involved in trading, money lending and factoring, as well as finance leasing and financial services in the People’s Republic of China and Hong Kong, with a market cap of HK$4.12 billion.

Operations: The company’s revenue is primarily derived from Trading (HK$113.18 million), followed by Money Lending and Factoring (HK$16.83 million), Finance Leasing (HK$8.94 million), and Financial Services (HK$5.99 million).

Market Cap: HK$4.12B

Hong Kong ChaoShang Group Limited, with a market cap of HK$4.12 billion, derives most of its revenue from trading activities. Despite having more cash than total debt and sufficient short-term assets to cover liabilities, the company remains unprofitable with declining earnings over the past five years. Recent management changes include appointing Mr. Chen Chao as an independent non-executive director, bringing expertise in artificial intelligence to the board. The company has filed follow-on equity offerings totaling HKD 986 million recently, indicating efforts to raise capital amid financial challenges and strategic shifts potentially highlighted by a proposed name change to Modern Innovative Digital Technology Company Limited.

Simply Wall St Financial Health Rating: ★★★★★☆

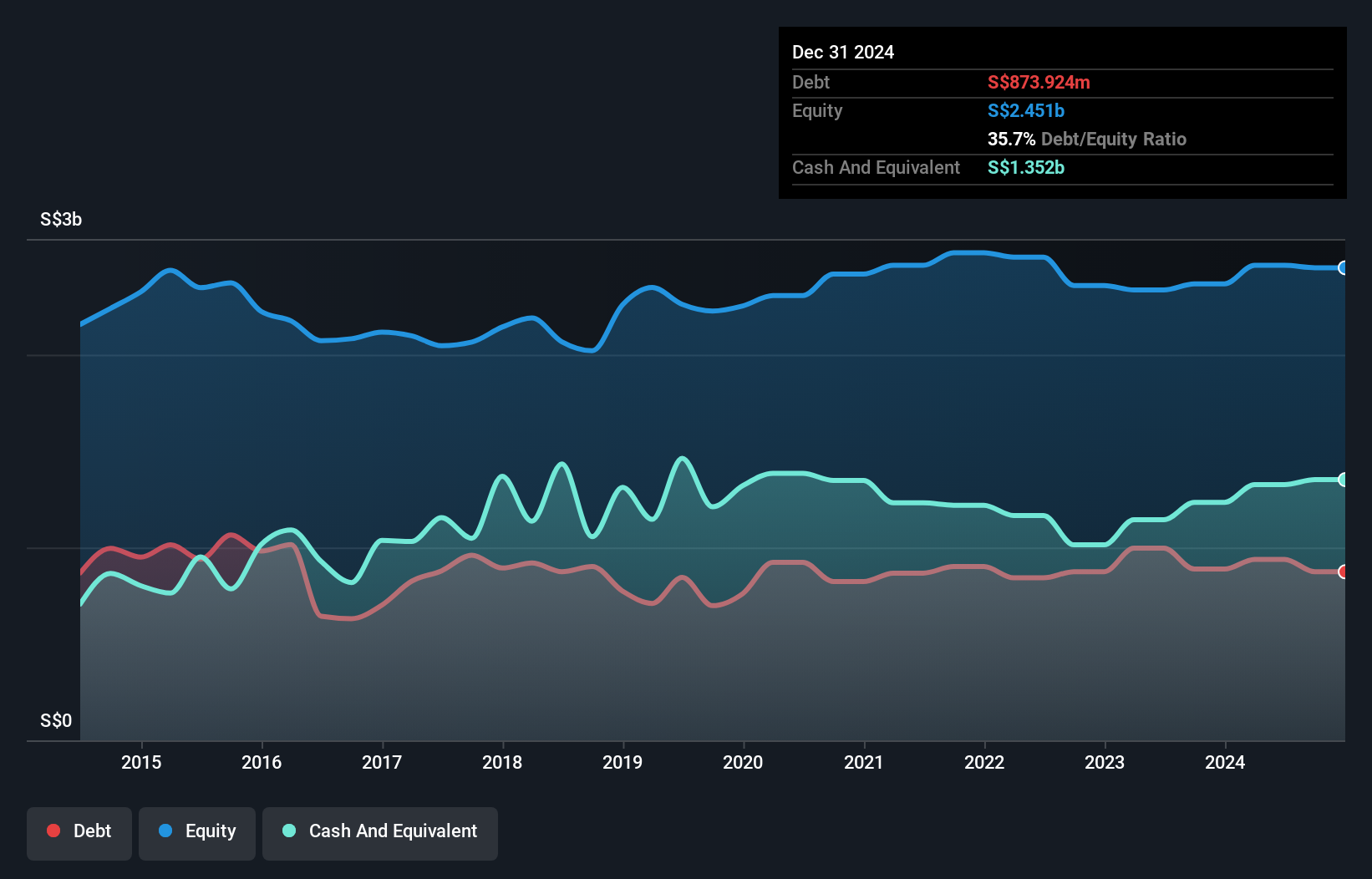

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products in China, Singapore, Malaysia, and internationally with a market cap of SGD673.18 million.

Operations: The company’s revenue is primarily derived from its Powertrain Solutions segment, generating SGD3.57 billion, followed by Building Materials at SGD665.81 million.

Market Cap: SGD673.18M

Hong Leong Asia Ltd., with a market cap of SGD673.18 million, has shown promising financial performance, reporting half-year sales of SGD2.25 billion and net income of SGD49.54 million, reflecting improved profit margins from 1.1% to 2%. The company’s robust short-term assets (SGD4.4 billion) comfortably cover both short-term and long-term liabilities, while its cash reserves exceed total debt levels. Recent expansions include the incorporation of subsidiaries in China to enhance its automotive services footprint. Despite a low return on equity at 6%, earnings have grown significantly by 94.4% over the past year, surpassing industry averages.

Simply Wall St Financial Health Rating: ★★★★★☆

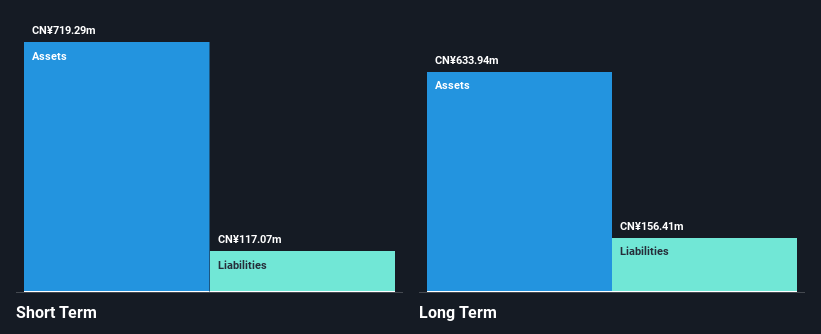

Overview: Tangel Culture Co., Ltd. operates in the research and development, distribution, agency, and operation of mobile games, book publishing and distribution, and educational businesses in China with a market cap of CN¥3.10 billion.

Operations: No specific revenue segments are reported for Tangel Culture Co., Ltd.

Market Cap: CN¥3.1B

Tangel Culture Co., Ltd., with a market cap of CN¥3.10 billion, has shown revenue growth, reporting sales of CN¥205.24 million for the first half of 2024, up from CN¥190.74 million the previous year. Despite this growth, the company remains unprofitable with a negative return on equity (-3.49%). However, it has reduced its losses at an annual rate of 18.9% over five years and maintains a strong financial position with short-term assets (CN¥760 million) exceeding both short-term and long-term liabilities. The company completed a share buyback program worth CN¥44.56 million in September 2024 without diluting shareholders significantly over the past year.

Next Steps

- Get an in-depth perspective on all 5,783 Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St’s portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It’s free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Read More: October 2024’s Promising Penny Stocks