P_Wei/E+ via Getty Images

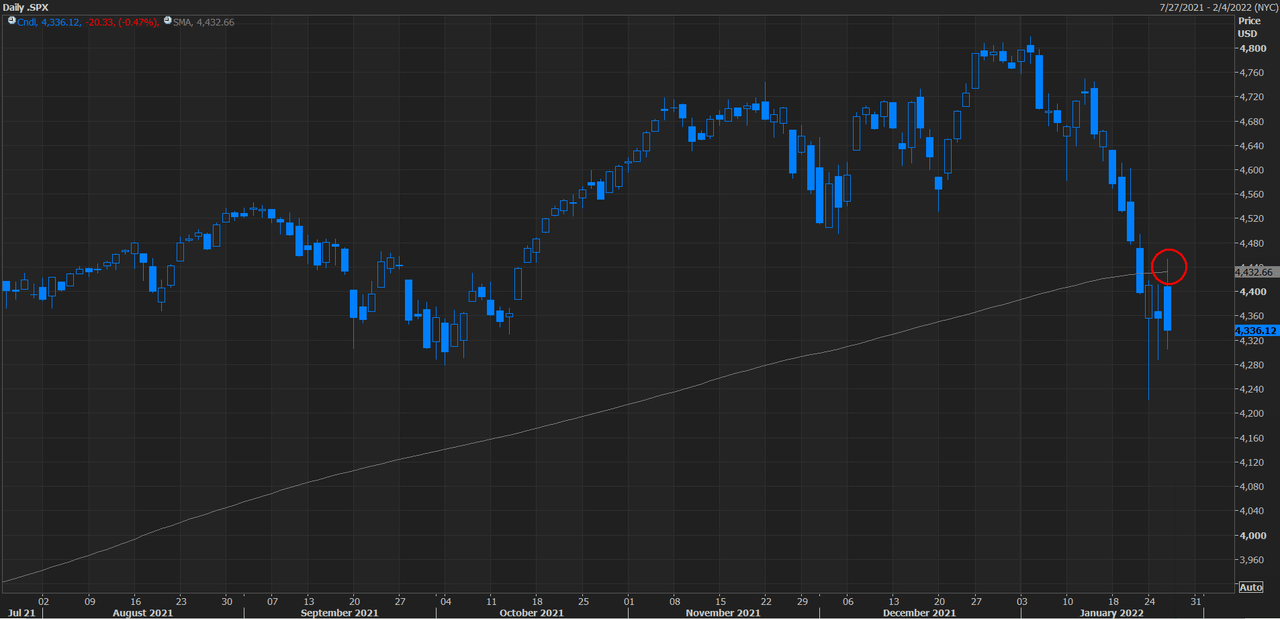

The S&P 500 and benchmark tracking ETFs SPDR S&P 500 Trust ETF (SPY), Vanguard S&P 500 ETF (VOO), and iShares Core S&P 500 ETF (IVV) came up short on Wednesday’s trading session as they can’t close above the 200-day moving average.

The index rallied through the 200-day moving average earlier in the trading session, rising as high as 2.2% on the day, but reversed its course once Fed Chairman Powell stated: “I think there’s quite a bit of room to raise rates without hurting the labor market.”

SPY, VOO, and IVV, which all track the S&P 500, each ended in the red -0.3%. See below a six-month chart of the S&P 500 and its shortfall in closing above the 200-day moving average.

The market index is currently sitting at the inflection point as the S&P 500 is -9.7% from its all-time high and hovering in and out of correction territory. The 200-day moving average acts as a critical hinge point that can help dictate the direction of the index.

The S&P 500 is not the only index to decline on the day, the Dow finished in the red, and the Nasdaq ended flat, erasing an earlier 3.5% rise.

Read More: S&P 500 ETFs can’t close above 200-day moving averages