Igor Kutyaev/iStock via Getty Images

Several readers commenting on my articles about the S&P 500 ETF, SPDR S&P 500 ETF (SPY) and Vanguard S&P 500 ETF (VOO) have asked me if it would be a better strategy to invest in the two ETFs that invest only in the “growth” component of the S&P 500. Those two subset ETFs are the SPDR Portfolio S&P 500 ETF (SPYG) and the Vanguard S&P 500 Growth ETF (VOOG). Both track the same index, the S&P 500 Growth Index.

This was an interesting question.

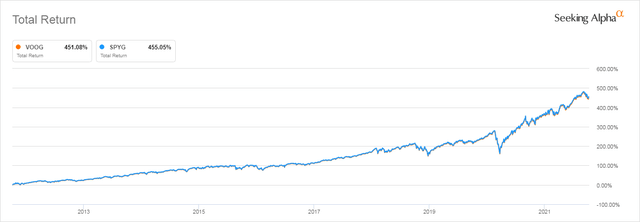

As I learned researching a recent article, though SPY and VOO track the same index, SPY has underperformed VOO, largely because of its much higher expense ratio. With that in mind, I expected that SPYG would also underperform its Vanguard counterpart, VOOG. But when I pulled up the charts, and looked at how SPYG and VOOG compared the total return of both over the past 10 years I found I was wrong. While the performance of the two ETFs that track the same index was very similar, as they should be, SPYG outperformed VOOG by a small but not insignificant 3%.

SPYG and VOOG 10-Year Total Return

Source: Seeking Alpha

The reason for SPYG’s outperformance became clear when I noticed that SPYG’s expense ratio is .04% while VOOG’s is more than double that at .10%. This was surprising given how much higher SPY’s .095% expense ratio is compared to VOO’s .030%. It is even more striking when we remember that both of these products have been around for decades during which Vanguard’s main selling point has been that it offered funds with cheaper expense ratios.

However, a quick look at Vanguard’s information page for VOOG gives us a bit more insight into why Vanguard hasn’t lowered its expense ratio on VOOG. Right at the top of the page Vanguard suggests that instead of buying VOOG investors “Consider Vanguard Growth ETF, which tracks the same market segment at a lower cost.”

It must be pointed out, though, that the Vanguard Growth ETF (VUG) does NOT track the same index as VOOG. It tracks a custom index that Vanguard has commissioned from CRSP. It costs Vanguard less to use than an S&P index, but it differs from VOOG in that it is a subset of an index that includes the unprofitable and highly speculative growth companies that S&P’s criteria exclude from its S&P 500 index-based sub-portfolios.

That Vanguard apparently wishes investors to avoid VOOG partially explains why Vanguard SPYG has far more assets under management than VOOG: $13.4 Billion compared to VOOG’s $6.8 Billion. But SPYG has also been around a lot longer than VOOG, having started to trade in September of 2000, a full decade before VOOG. So it is also likely that Vanguard hoped to steal some of SPYG’s thunder as they did that of SPY when they launched VOO, but failed.

So with all this in mind, in the rest of this article, I am going to focus on SPYG and what it offers to investors considering tilting their investment in a Large Cap broad market index fund to Growth stocks rather than buying the whole S&P 500 index.

SPYG vs SPY Performance in Different Time Frames

As always, when trying to get a feel for how an ETF might perform, I started out by looking at its past performance, though I am very well aware that back testing can be very misleading, especially if we look at past performance without taking into account the economic and market sentiment factors that prevailed during the past periods we are looking back at.

We also have to be very well aware that the choice of start and end points can make a huge difference in the historical performance of any stock or ETF. Fund companies know this and, not surprisingly, are very selective about the time frames they highlight when promoting their products.

So I always look at lots of different time frames, and at a time like this, when the market is at an extreme high, though I start out looking at performance until now, I also like to look at performance during periods that don’t end at the present day, too.

SPYG Has Been Outperforming for a Long Time

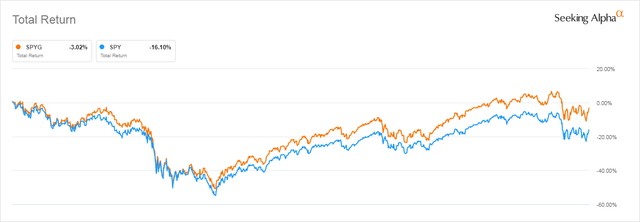

Chart SPYG for any time frame from 2007 to the present and you will see that it has outperformed SPY. That outperformance really kicked in around 2017 when the FAANGs started to dominate the S&P 500 index, as you can see in the chart below.

SPYG vs SPY Total Return 2011-2021

Source: Seeking Alpha

But even in the earlier five-year period surrounding the Financial Crisis when the market was far from being irrationally exuberant and investors who had bought at the pre-Financial Crisis high were still licking their wounds, SPYG also outperformed as you can see from the chart below, albeit that both were still in negative territory.

SPYG vs SPY Total Return 2007-2011

Source: Seeking Alpha

Let me note for investors who focus on dividends that these Total Return charts also include the dividends paid by the stocks in both ETFs. So SPYG still outperformed SPY during a period when dividends were a significant part of the return of SPY.

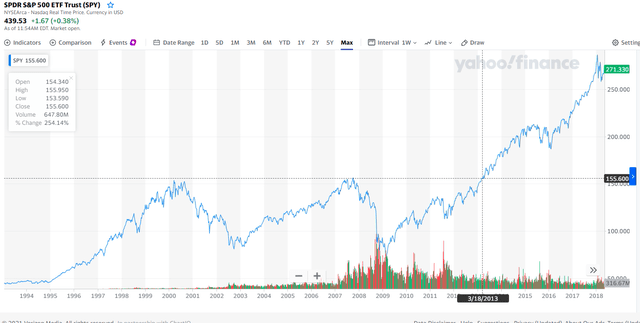

But before we assume that we can safely invest in SPYG and expect this outperformance to continue, we have to look further back in time. SPYG started trading on September 25, 2000. This was just a week or so after the point where the Dot.com boom ended and the S&P 500’s price started to decline. It kept on declining steadily for the next three years, and it wasn’t until another three years had passed – in 2006 – that SPY reached the level where it had been in the summer of 2000. Then, of course, it declined steeply, again, during the Financial Crisis, regaining its 2006 height only in 2013 as you can see in the chart below.

SPY Long Term Performance

Source: Yahoo Finance

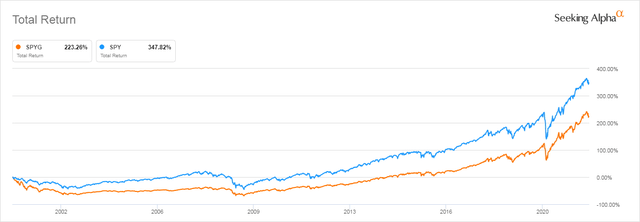

As the decline in the S&P 500 as a whole was largely driven by the extreme valuations given to a host of internet-related Tech stocks, you would expect SPYG to have underperformed during this earlier period, and you would be right. As you can see, since its inception, SPYG not only underperformed the broader S&P 500 but the margin of its underperformance was large enough that even with the exuberant performance of growth stocks since 2017, investors who bought and held SPYG in 2000 and held it until now would still have significantly underperformed the total S&P 500 ETF, SPY.

SPYG and SPY Total Return-Sept 25, 2000 to Now

Source: Seeking Alpha

Why This Long-Term Underperformance?

This underperformance of SPYG after the dot.com boom is particularly interesting because the way that the S&P 500 index is constructed kept it from buying the speculative dot.com stocks most associated with the 1990s boom and subsequent bust: Pets.com and its peers. That’s because to be included in the S&P 500 index stocks must pass a profitability screen. As S&P Global tells us in its portfolio construction documentation:

To be eligible for S&P 500 index inclusion, a company should be a U.S. company, have a market capitalization of at least USD 11.8 billion, be highly liquid, have a public float of at least 10% of its shares outstanding, and its most recent quarter’s earnings and the sum of its trailing four consecutive quarters’ earnings must be positive…”

The market cap size requirement has grown over the years. It would have been smaller in the 1990s, but it would still have been large enough to eliminate many start-ups. So you would think that these criteria would have screened out the highly speculative offenders of the Dot.com era that were earning only eyeballs, despite their large market caps.

But the explanation for SPYG’s startling long-term underperformance isn’t hard to find. The overall P/E ratio of the S&P 500 in 1999 was a very elevated 32.92. But the profitable growth stocks it held in 2000, most notably Microsoft (MSFT), Intel (INTC), Cisco Systems (CSCO), and Dell, were trading at far more extreme multiples. At the start of 2000, Microsoft, for example, had a P/E ratio of 70.75. Cisco’s was 196.77. Though these companies continued to dominate their industries and be profitable, their prices dropped to levels that produced more reasonable valuations.

Microsoft P/E Ratio from 2000 Dot.Com Peak to 2013

Source: Seeking Alpha

The return of their pricing to reflect more reasonable valuations devastated investor returns for 14 very long years.

Microsoft Total Return from 2000 Dot.Com Peak to 2013

Source: Seeking Alpha

Back Testing Thus Confirms the Obvious

SPYG will outperform when it is bought at times when growth stocks are reasonably valued. Investors who buy it when it is well valued and hold it through periods when growth stocks again attract enthusiastic investors willing to pay any price for them will do extremely well.

But the ETF that holds the entire S&P 500, not just growth stocks is a better buy when growth stocks display P/E ratios that would only be justified if the stocks achieved rates of growth that are impossible for most to maintain. Buying SPYG at a market top, when valuations have become extreme, can really hurt you.

I Can’t Find My Crystal Ball No Matter How Hard I Look

So the big – and obvious – question is are we in a period like that now? And that is a very tough question to answer. People have been predicting that tech stocks will suffer another 2000-like correction ever since 2015 when the P/E ratio of the S&P 500 breached 20. Those who heeded these warnings have missed out on shockingly large gains.

But if you think I’m going to tell you if we have reached the point where those warnings will finally be true, I’m afraid I will have to disappoint you. I have a strong suspicion that a tech-driven growth correction will arrive, but I have no idea when.

Alan Greenspan gave his famous speech warning of “Irrational Exuberance” on December 5, 1996. It was four long years until his warning bore fruit. Investors who bought SPY in 1996 would have made enough gains before the final dot.com crash to still come out with juicy profits through 2013. (They couldn’t have bought SPYG in 1996 because it didn’t exist until 2000.)

SPY Gains from Irrational Exuberance Speech to the Start of 2013

Source: Seeking Alpha

A Closer Look at What’s In SPYG

While I can’t predict the future, I can look at what is currently in SPYG and how it is valued.

A Sloppy Definition of Growth

SPYG holds 243 stocks which is just a hair under half of all the stocks in the full S&P 500. That is a lot of stocks to classify as “growth stocks.” Especially if you think of growth stocks as being a somewhat special subset of the market made up of stocks we expect to increase their earnings at a much higher than average rate.

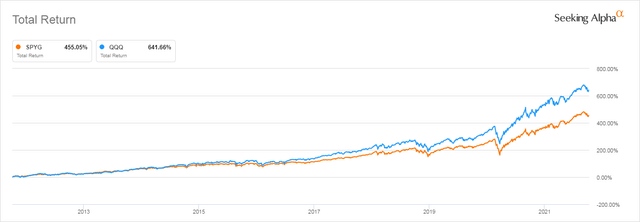

Those 243 stocks are 143 more stocks than what appear in QQQ, which is a much more popular choice for investors looking to invest in a growth-heavy ETF. And as you can see, QQQ has outperformed SPYG handily during the past 10 years as growth stocks came to dominate the market.

SPYG and QQQ 10 Year Total Return

Source: Seeking Alpha

So given that the S&P 500 Index appears to consider almost half of the stocks it holds as growth stocks, it is immediately obvious that S&P 500 must use a simplistic algorithm to pick supposed growth stocks, one that we have to assume includes a lot of stocks that are not what you might think of when you think Growth. “Growth traps” if you will.

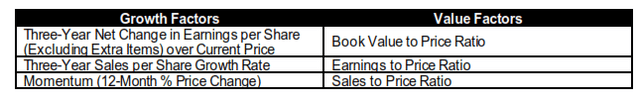

And this is exactly what we find when we delve into the S&P Style Index Methodology documentation. The index constructors use a relatively simple technique to sort all the stocks in the parent S&P 500 index into Growth or Value sub-indexes. The methodology document obfuscates the process by using a lot of fancy statistical terms, but essentially what they do is first evaluate all the stocks in the parent index using three criteria for Growth and three different criteria for Value, as you can see in this table:

S&P Global’s Sorting Criteria for Growth and Value

Source: S&P Global

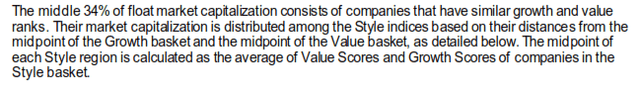

Then they split all the stocks into the parent index into three groups each of which is made up of 1/3 of the stocks in entire index: one group contains those with the higher Growth factors. The second holds those with the higher Value factors. The third is made up of stocks that don’t really look like either Growth of Value based on the above simple screens.

Here’s how S&P Global explains what they do next:

All of which explains why the S&P 500 Growth index holds almost half of all the stocks in the S&P 500, since almost half of the stocks that aren’t really Growth or Value still get put into the Growth index.

How the Stocks in SPYG and SPY Differ

So what are those stocks and can looking at them more closely give us a better idea of how SPYG will perform, compared to SPY, going forward?

SPYG is Far More Top Heavy

I downloaded the list of SPY and SPYG holdings as of October 8, 2021, from S&P Global. The first thing that struck me was that, while most investors by now are very well aware that SPY has become very top-heavy with 28.18% of its value as of October 8 being made up of only 10 stocks, the concentration of value in SPYG is even worse.

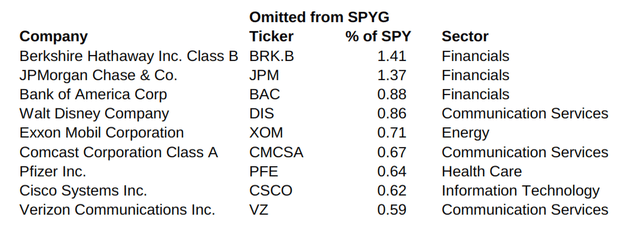

Fully 50.41% of the value of SPYG lies in its top 10 stocks. Those top 10 stocks are identical to those held by SPY save SPYG omits Berkshire Hathaway (BRK.B) and JPMorgan Chase (JPM), and includes PayPal (PYPL) and Nvidia (NVDA).

I then compared the top 30 stocks found in SPYG, which make up 67.6% of the value of the entire ETF with the top 30 stocks in SPY which make up 43.9% of its value.

The stocks that appear in SPY that were omitted from SPYG (with their weights in SPY) were:

Source: SSGA.com SPY and SPYG portfolio Holdings

A Closer Look at Growth Rates and P/E Ratios

According to fund provider, State Street Global Advisors, The P/E ratio of SPYG now is 28.85. That of SPY is 21.27. So looking at it very crudely SPYG is far more highly valued. But given that SPYG holds growth stocks, you’d expect a higher valuation. It is also true that, as is almost always the case with ETFs, it is hard to know how that P/E ratio is computed. So it is worth looking more closely that the P/E ratios and some other valuation metrics for the individual stocks in SPYG.

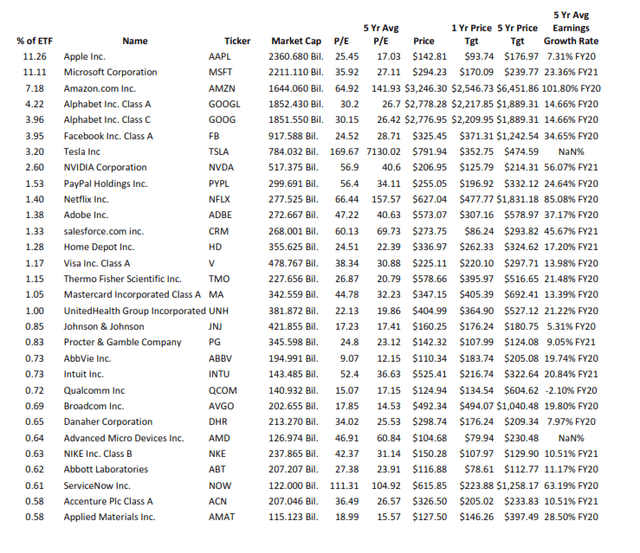

I ran the top 30 companies in SPYG through FastGraphs portfolio feature to see what their current P/E ratios might be, what their historical five-year average P/E ratios had been, and what their growth rates over the past five years look like, seeking to get a feeling for whether the higher P/E ratios corresponded to earnings growth rates high enough to justify them.

I would urge you to spend some time with this table if you are trying to get a feel for whether the overvaluation of the Growth stocks in SPYG might make it perform the way it did in the 2000s should the stocks that make up two-thirds of its value revert to P/E ratios more in line with their historical values and/or their actual rates of growth.

SPYG Top 30 Stocks – Selected Valuation Metrics

Source: State Street Global Advisors, fastgraphs.com data from FactSet and S&P Global, table by the author

As you can see the stocks making up two-thirds of the value of SPYG do have P/E ratios, on the whole, that are much higher than their five-year average P/Es. The exceptions are stocks like Amazon (AMZN) and Netflix (NFLX) that had extremely low earnings in the past which resulted in their having very high P/Es, but now have grown earnings to where their P/Es have declined, though they are still very high.

How Different are the Sector Allocations?

Since there are still another 213 stocks in SPYG, I thought it would be worth taking a look at a few other metrics that State Street Global Advisors provide for SPYG to see how they compare with the parent index, SPY.

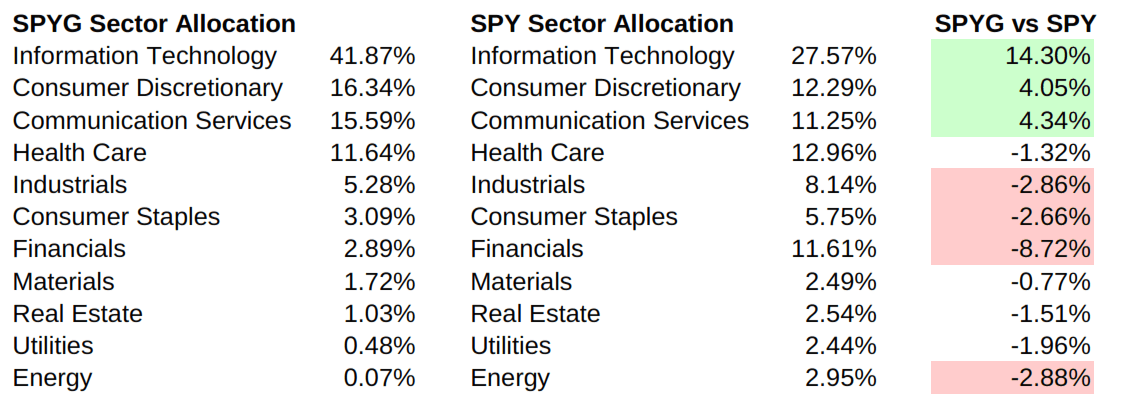

Since three out of the nine stocks omitted from SPYG’s top 30 are Financials and another three are in the Communications Services sector, I took a closer look at the sector breakdown of SPY and SPYG to see this difference applied to the ETF as a whole.

The table below compares the sector allocations as reported on SPYG and SPY’s Holdings pages and tabulates the difference between the percentage held in SPYG and that held in SPY:

Sector Allocation Differences Between SPYG and SPY

Source: SSGA.com SPY and SPYG Portfolio Holdings, Table by Author

As you can see from the column to the far right, SPYG is, as you might expect, far more concentrated in Information Technology than is SPY. But it is also more concentrated in the Consumer Discretionary and Communications Services sector, even though it omits several large, sluggish companies that also fall into the Communication Sector that SPY holds. SPYG’s lack of Verizon (VZ), Comcast (CMCSA), and Walt Disney (DIS) is balanced by its much larger holdings in Alphabet’s two stock classes (GOOG) and (GOOGL), Facebook (FB), and Netflix (NFLX).

And just as was the case when we compared the top 30 stocks in SPYG and SPY, Financials are severely underrepresented in SPYG compared to SPY. To a lesser extent, we also find a lower allocation to Industrials, Consumer Staples, and Energy stocks in SPYG, too.

Bottom Line: An Investment in SPYG Now is a Bet that the Valuations of Growth Stocks will Remain High

You can’t evaluate growth stocks the way you do those of more stable companies. Momentum plays a far bigger role in their pricing than it does with what are thought of as value stocks. Whatever their P/E ratios or growth rates have been, the stocks that dominate SPYG right now are still those that attract the investors looking for big profits. When or even if that will end is impossible to know.

The impact of inflation and rising rates on these momentum-driven growth stocks might be a huge factor going forward. The lack of Financials in SPYG might also be an issue – though if they start to surge, they will be added to SPYG the next time that the index is reconstituted and the stocks in the S&P 500 sorted again into Growth and Value.

SPYG won’t give you the performance that QQQ will at times when the market completely ignores valuation and falls in love with unprofitable speculative stocks, but it will excel at times when growth is in favor. But the decision of whether you would be better off buying it now rather than investing in the more diversified SPY is beyond my predictive powers.

Read More: SPY Vs. SPYG: How To Compare These ETFs