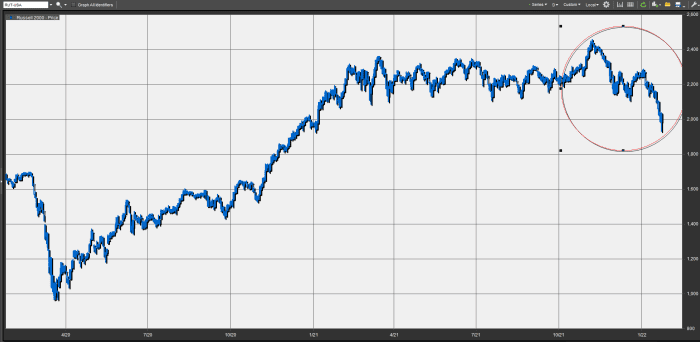

The Russell 2000 index, which gauges the performance of small-capitalization stocks, ended Thursday down more than 20% from its recent high, meeting the commonly used definition of a bear market.

The index

RUT,

which closed at a record of 2,442.742 on Nov. 8, finished about 21% from its peak on Thursday, marking its first bear market since March 9, 2020. The index needed to avoid a close at or below 1,954.19 to avert a bear market, but selling pressure forced the index deep into the red.

FactSet

The index led the way in the past stock-market downturn in 2020 as the COVID pandemic took hold in the U.S. The benchmark is often viewed as an area of the market that tends to be more sensitive to concerns about economic growth, rising inflation and rising interest rates, all conditions that the economy is experiencing or will likely experience in coming months as the U.S. Federal Reserve sets the stage for a series of rate increases starting in March.

After the Russell 2000 index entered a bear market in early March, the Dow Jones Industrial Average

DJIA,

closed in bear market on March 11. The S&P 500

SPX,

and Nasdaq Composite

COMP,

entered bear markets a day later.

Flash forward to 2022 and the Nasdaq Composite is already in correction, defined as a decline of at least 10% (but not more than 20%) from its Nov. 19 peak. The index is about 17% from its November peak and the S&P 500 stands about 10 points from a correction, as of Thursday’s close.

Read More: Stock-market index that led the pandemic-fueled tumble just entered a bear-market for the