allanswart

The broader market is close to the end of its recent bullish move and December will likely disappoint investors looking for a strong year-end rally, according to BTIG.

The S&P 500 (SP500) (NYSEARCA:SPY) is entering a “difficult area of resistance” in a downtrend from the January highs and the falling 200-day moving average of 4,050-4,080, Jonathan Krinsky, strategist and chief market technician, wrote in a note.

“While this may seem too obvious, the August rally stalled precisely at the falling 200 DMA,” Krinsky said.

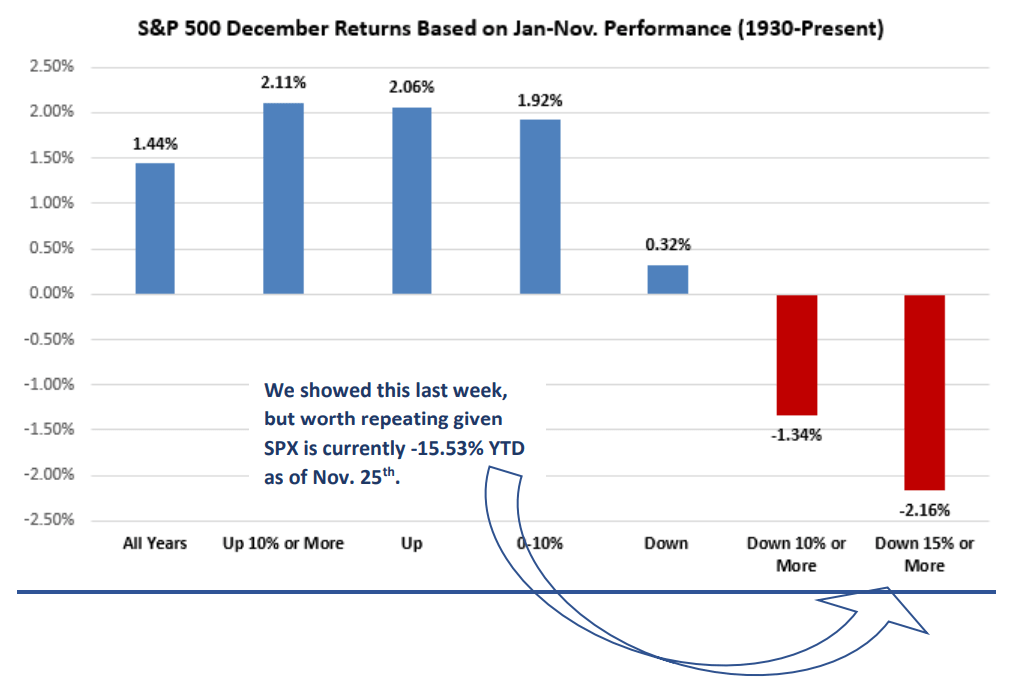

“As a reminder, Decembers are much weaker when the SPX is -15% or worse through November,” he added.

With the bear market not over, high-flying chip stocks are vulnerable, Krinsky said.

“In tech-land, the Philadelphia Semiconductor Index (SOXX) rallied ~27% over 25 days, the largest such move since April 2020,” he noted. “Since the late ‘90s, this has happened just a handful of times while below the 200 DMA.”

“Like many extreme moves, some occurred within a bear market (‘01, Jan. ’09, Aug. ’22) while others occurred at the start of new bulls (Nov. ’02, Apr. ’09, Apr. ’20).”

Relative to software (IGV), semis have seen the largest 25-day move since 2003, which bodes well for software stocks, Krinsky said.

Semi stocks with vulnerable charts include Broadcom (AVGO), Lam Research (LRCX), Skyworks Solutions (SWKS) and Qorvo (QRVO).

Constructive software names include Progress Software (PRGS), Tyler Technologies (TYL), Unity Software (U) and Workiva (WK).

See BofA’s top 10 trades for 2023.

Read More: Tail end of the S&P countertrend rally is nearing – BTIG