FatCamera/E+ via Getty Images

Investment thesis

Shares of the telehealth leader are down 74% in the past year. Teladoc (NYSE:TDOC) stock reached all-time highs in early 2021 owing to impressive growth during the pandemic. Soon thereafter, we returned to “normal” life and investors began overlooking the healthcare company. More recently, the stock has experienced even more downward pressure in response to rising interest rates. Once a very expensive stock, Teladoc has seen its trading multiples contract significantly in recent months. Short-term uproar may cause the stock to decline further, and I think that would present an excellent buying opportunity for long-term investors. Fortune Business Insights forecasts that the global telehealth market will grow at a compound annual growth rate of 32% to $636 billion by 2028. Teladoc is a sure leader in the space, and strong fundamentals matched with an increasingly attractive valuation make the company an enticing buy. The company is led by Jason Gorevic, a true pioneer of virtual medicine with 20+ years of healthcare experience. Strong leadership has led to Teladoc being ranked 1st in consumer satisfaction by the J.D. Power U.S. Telehealth Satisfaction Study two out of the past three years. The company recently established new agreements with CVS Health (NYSE:CVS) & Centene (NYSE:CNC) to provide Teladoc’s Primary360 to customers, a significant step in scaling its business. Increased competition is unavoidable in an industry forecasted to experience such robust growth over the next decade. That said, I think Teladoc has the right management and tools in its toolbox to maintain its position as an industry leader moving forward.

YCharts

Financials are improving

Teladoc’s ongoing pitfall is surely not a result of weak fundamentals. The company’s reported revenue and adjusted EBITDA in the third quarter of 2021 was $522 million and $67 million, respectively, representing a year-over revenue growth of 81% and EBITDA growth of 71%. Total visits increased 37%, and per member per month (PMPM) grew 118%. Analysts are forecasting $2.0 billion in revenue for the full year 2021, indicating a robust 85% increase. Growth is forecasted to decelerate in the coming years. Still, Wall Street is estimating that Teladoc’s revenue will grow at an average annualized rate of 35% to $5.0 billion by 2025. Profitability is likely still a few years out, with most analysts forecasting that Teladoc will achieve its first full year of profitability in 2024. That seems like a long time away, but a patient mindset with Teladoc could reward investors significantly in the future. After all, the company has been showing positive trends indicating that future profitability is likely. Teladoc is expected to report a net loss of $3.18/share in 2021, resulting in 41% growth from -$5.36/share in the fiscal year 2020. The consensus EPS estimate for the fiscal year 2025 is $2.57/share, or 181% growth from 2021 expectations. Teladoc’s balance sheet further solidifies the confidence I have in the company’s future success. With hardly any debt in relation to equity, Teladoc comprises of $1.3 billion in debt, $16.0 billion in total equity, and $824 million in cash. A strong balance sheet gives the company more flexibility as it navigates its journey to a positive net income. Cash flow signs are becoming increasingly upbeat as well. In the past two quarters, Teladoc generated levered free cash flow of $50 million and $75 million, respectively. I expect favorable trends in cash flow generation to continue for Teladoc moving forward.

Attractive valuation

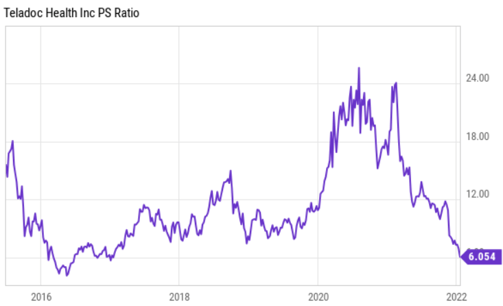

Teladoc’s valuation multiples have contracted significantly in recent months. The company is currently trading at 6x sales, notably lower than its five-year historical average of 14.5x. See the chart below for an illustration of Teladoc’s multiple contraction. Let’s say that Teladoc generates $2.57 billion in revenue in fiscal year 2022, which is in line with Wall Street estimates. By applying a price/sales multiple of 8x (on par with the healthcare technology industry average), you arrive at a price target of $129/share, representing 72% upside from today.

YCharts

Downside

As with any investment, Teladoc presents several risks. For starters, competition in the industry is heating up. Both traditional healthcare companies and newcomers continue to enter the telehealth market, potentially putting pressure on Teladoc’s future market share. Even Amazon (NASDAQ:AMZN) has dipped its toes in the arena, reportedly looking to launch its app-based home visits in dozens of major cities through 2022. Moreover, Teladoc’s paid member growth has been sluggish, growing only ~4% so far in the fiscal year 2021. Full-year management guidance suggesting that paid memberships will total between 52.5 million and 53.5 million implies relatively stagnant growth year-over-year. Teladoc will want – and need – to improve this metric moving forward in order to expedite its journey to profitability. Investors should also consider valuation risk when analyzing Teladoc. Yes, the company’s price/sales multiple has dipped below its historical average and the industry mean. That said, trading at 6 times sales could still be considered expensive when comparing it to the broader market.

In the end

I believe Teladoc presents a favorable risk-reward scenario in today’s market. The company is a leading participant in an industry that is set to grow at a rapid pace throughout the next decade. And what is more, Teladoc’s fundamentals remain strong. This presents a dream scenario for canny investors: Unaltered financials paired with a rapidly declining valuation. It is possible that Teladoc will fall even further; however, I think today is still a good time to acquire shares. Long-term investors can benefit from the short-term turbulence overtaking today’s market.

Read More: Teladoc (TDOC): A Healthcare Stock Worth Considering Today