This week will be one of the most volatile weeks of the year. It won’t matter if you’re trading penny stocks or not, the final round of major economic data and central bank meetings from the FOMC are front and center. We’ve also got another rate hike decision coming and more employment data to digest. There is no shortage of catalysts, and if you’re looking for penny stocks to buy, it might be more than just jumping on the momentum train.

Monday has already been full of quick movers. Penny stocks like HTG Molecular (NASDAQ: HTGM), Aptevo Therapeutics (NASDAQ: APVO), and Clovis Oncology (NASDAQ: CLVS) have put in new highs and almost immediately pulled back. Unless you’re quick with the sell button, chances are you might’ve missed these early moves.

So how does anyone find penny stocks to buy right now? The short answer some have found solace in is “alternative” data. This includes things like insider trading, short interest, hedge fund trading, and, as we’ll discuss today, unusual options activity. In all cases, these data points don’t directly contribute to real-time price movements.

They are used a bit differently, however. Traders will take them as signals of interest and sentiment. Of course, there aren’t any guarantees that bullish sentiment translates to significant buying in the market. That also goes for bearish sentiment and selling. However, alternative data has been used to get “clues” about what the market, or “big money,” thinks about specific companies.

Penny Stocks & Unusual Options Activity

If you’re new to options, in general, and this sounds foreign to you, check out our primer on options basics: Trading Options 101: A Beginner’s Guide. Traders have used unusual options activity to identify potentially bullish or bearish moves in the market that typically happen around specific company events.

Now, these “events” can be confirmed or speculated on. For instance, a few months ago, we found unusual options activity in a particular biotechnology stock in an options chain that was roughly one month in the future. The particular expiration date was the closest date related to an upcoming clinical study data readout.

The company ultimately reported mixed data, and shares saw a pullback. But leading up to the date, the biotech penny stock rallied. This isn’t always the case when it comes to unusual options data. Most of the time, speculation is a more significant factor at play. What traders think might happen tends to drive the action, which presents a very high-risk environment. Nevertheless, this alternative data might be helpful for traders looking for such a scenario.

– How to Manage Risk When Investing in Penny Stocks

In this article, we look at a few companies that have seen irregular activity in their options chains recently. We dive into what has previously acted as a catalyst. We’ll also search for any upcoming events that could contribute to potential speculation.

Penny Stocks To Watch With Unusual Options Action

Innoviz Technologies Ltd. (INVZ)

Shares of Innoviz have maintained a higher trading channel since gapping up in August. While this is a relatively wide range between the $4.40 area and $6.20 area, it is a clear channel on the chart. Before that, INVZ stock was also range-bound but in a much lower channel.

What happened in August had everything to do with news. Innoviz announced a design win with CARIAD. The company selected Innoviz as a direct LiDAR supplier for a segment of automated vehicles in the Volkswagen brand. This deal also brought Innoviz’s forward-looking order book to $6.6 billion.

Fast-forward to right now, and we see INVZ stock is bouncing back from recent lows. Since it released earnings last month, there haven’t been many new updates from Innoviz. However, an upcoming event might be on the minds of traders with INVZ on their list of penny stocks. Next month, on the 5th, Innoviz management will participate in the JP Morgan Tech/Auto Forum. There will also be one-on-one investor meetings scheduled between the 5th and 8th.

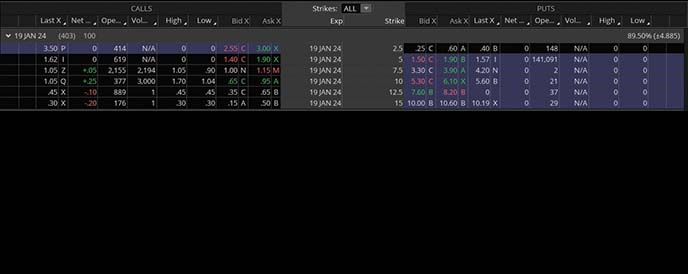

Regarding unusual options activity, we looked at the 2024 expiration, which is only for January 19th, 2024, as of now. The $10 calls saw 3,000 in contract volume compared to 377 open interest. There was also a higher volume in the $7.50 Calls for that same expiration.

Faraday Future Intelligent Electric Inc. (FFIE)

Penny stocks under $1 are becoming a hot topic this month. It’s one of the most frequently searched-for niches on the site, and Faraday Future has held a spot on that list. The beaten-down EV stock has seen somewhat of a turnaround in the stock market this month. In fact, over the last week or so, FFIE stock has bounced from 52-week lows of $0.245 to highs this week of more than $0.50.

Faraday replaced its CEO and selected a LiDAR provider, Innovusion, for its flagship FF 91 Futuris EV.

“Innovusion is a leader in high-resolution, ultra-long-distance, laser-based automotive sensors. Incorporating this advanced LiDAR technology into the FF 91 is very exciting and supports our efforts to deliver the uniquely positioned FF 91 to the market,” said Hong Rao, vice president IAI at Faraday Future.

The company hosts a Business Update Meeting this week on the 15th. It will discuss the business transformation plan, including the delivery plan for the FF 91 Futurist. Ahead of the meeting, the options market is beginning to perk up, specifically next week’s December 23, 2022, $0.50 Calls. As of the article being published, more than 3300 contracts were traded.

Danimer Scientific Inc. (DNMR)

Shares of Danimer Scientific’s stock hit fresh 52-week lows on Monday. The move continues a long stretch of downward movement that recent earnings results have amplified. The company reported a loss per share of 94 cents compared to expectations of 17 cents. It also missed sales estimates for the quarter. Management remains optimistic about the future.

– How to Find and Evaluate Penny Stocks For Your Portfolio

CEO Stephen Croskrey went as far as to say, “Based on expected customer demand momentum, we believe our existing operations can provide us with sufficient cash flow to run the business effectively as volumes grow. In our view, customer commitments to sustainability and regulatory tailwinds overshadow inflation and supply chain constraints and continue to support a robust outlook for Danimer and our planned capacity additions in coming years.”

Danimer specializes in plastic products made via sustainable methods. Using renewable biopolymers has allowed it to create plastic products that are biodegradable and compostable. By the look of the options market, there are some exciting things to watch in the January 17, 2025 expiration Calls. In particular, the $7.50 strike saw more than 1400 contracts traded compared to an open interest already over 3000.

List Of Penny Stocks To Watch [Unusual Options Edition]

Read More: Top Penny Stocks To Buy This Week? 3 With Unusual Options To Watch Now