Editor’s Note: This article has been updated to correct the spelling of the analyst’s name and the associated website.

The world’s largest exchange-traded fund by assets under management is experiencing significant capital outflows, yet this trend is not minimally disrupting the U.S. stock market’s performance.

The SPDR S&P 500 ETF Trust SPY, with over $526 billion in AUM, is undergoing a substantial outflow that could dethrone it as the leading S&P 500 ETF.

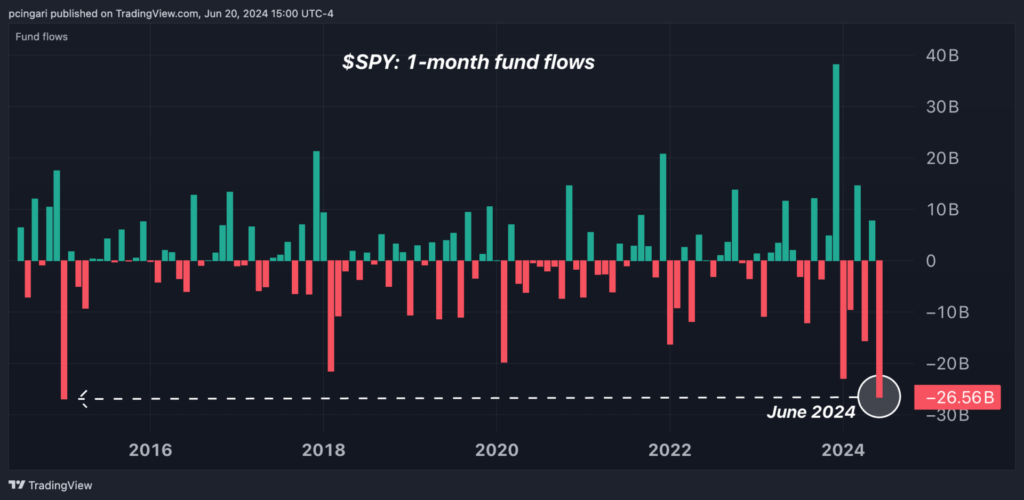

Year-to-date, outflows have exceeded $40 billion, while in June 2024 only, the SPY ETF experienced $26.6 billion in outflows.

With seven trading days remaining, this could be its second-worst month for outflows, surpassed only by January 2015.

Sumit Roy, senior ETF analyst at etf.com, remarked, “On the surface, such massive outflows for SPY are strange to see in a year in which the S&P 500 is hitting record highs. But SPY isn’t like most other S&P 500 ETFs.”

As the expert noted, a diverse range of market participants uses the SPY fund to express their views, from short-term traders to long-term investors. It also boasts the most extensive options market of any ETF.

In contrast, other popular S&P 500 ETFs like the Vanguard 500 Index Fund ETF VOO and the iShares Core S&P 500 ETF IVV tend to attract a narrower group of predominantly long-term investors, Roy added.

An in-depth analysis of these three major ETFs tracking the S&P 500 reveals that the SPY ETF has the highest costs. The SPY’s expense ratio, which represents the annual fee investors pay to the fund’s managers, is 0.09%, three times higher than the Vanguard 500 Index Fund and the iShares Core S&P 500 ETF.

| ETF | Expense Ratio |

|---|---|

| SPDR S&P 500 ETF Trust | 0.09% |

| Vanguard 500 Index Fund ETF | 0.03% |

| iShares Core S&P 500 ETF | 0.03% |

The Vanguard 500 Index Fund ETF is currently on an 18-month streak of positive monthly inflows, drawing $45 billion year-to-date. The iShares Core S&P 500 ETF recorded $20.8 billion in inflows year-to-date.

| ETF | Year-to-Date Fund Flows |

|---|---|

| SPDR S&P 500 ETF Trust | -$41.5 billion |

| Vanguard 500 Index Fund ETF | $45.4 billion |

| iShares Core S&P 500 ETF | $20.8 billion |

This indicates investors are likely fleeing the SPY due to its higher costs, transferring their funds to lower-cost ETFs tracking the same index.

This migration explains why the broader U.S. stock market remains unaffected by the heavy outflows from the world’s largest ETF.

The inflows into the Vanguard and iShares ETFs have more than compensated for SPY’s outflows, maintaining market stability.

Read more: Big Tech Dominance: 5 Companies Projected To Lap Average S&P 500 Stock’s Earnings Growth

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read More: World’s Biggest S&P 500 ETF Bleeds Outflows: Why Isn’t The Market Crashing? (CORRECTED) –