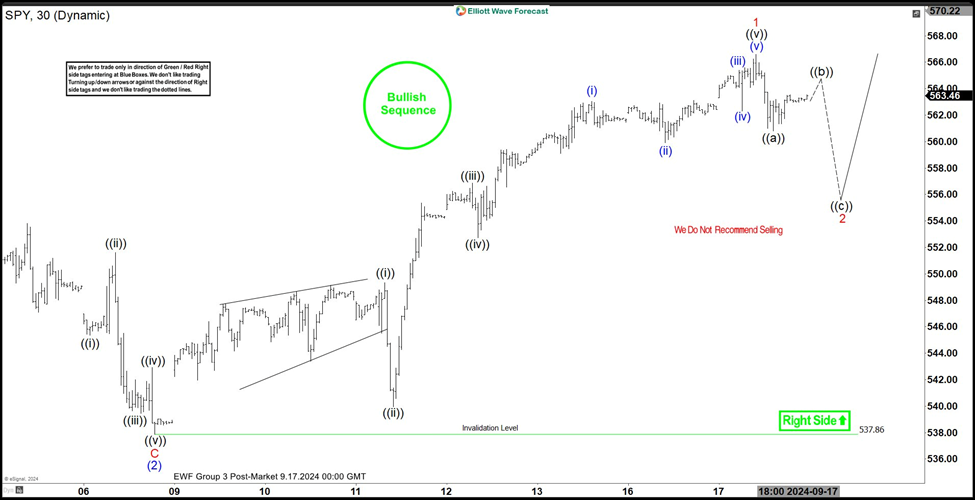

Short term Elliott Wave view on S&P 500 ETF (SPY) suggests that cycle from 8.5.2024 low is unfolding as a 5 waves impulse. Up from 8.5.2024 low, wave (1) ended at 564.2 and pullback in wave (2) ended at 539.44. The ETF has extended to new all-time high in wave (3). The internal subdivision of wave (3) takes the form of another 5 waves in lesser degree. Up from wave (2), wave ((i)) ended at 549.34 and dips in wave ((ii)) ended at 539.96. Wave ((iii)) higher ended at 556.85 and pullback in wave ((iv)) ended at 552.74. Final leg wave ((v)) ended at 566.58 which completed wave 1 in higher degree.

Pullback in wave 2 is in progress to correct cycle from 9.7.2024 low with internal subdivision as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 560.79. Expect wave ((b)) to fail below 566.58 for another leg lower in wave ((c)) to complete wave 2. Afterwards, the ETF should then resume higher. Near term, as far as pivot at 537.86 low stays intact, expect pullback to find buyers in 3, 7, or 11 swing for further upside.

S&P 500 ETF (SPY) 60 minutes Elliott Wave chart

SPY Elliott Wave [Video]

Read More: S&P 500 ETF (SPY) new all-time high suggests right side remains higher [Video]