designer491/iStock via Getty Images

Thesis and background

The SPDR S&P 500 Trust ETF (SPY) offers diversified exposure to the overall U.S. economy – which I am very optimistic about in the long run. Probably like you, we hold this fund as a cornerstone in our retirement funds, and a large portion of our family assets is invested in this fund. However, you might be concerned about SPY given the fund’s current valuation, the unfolding macroeconomics uncertainties (e.g., inflation, interest rates, et al), and also the geopolitical uncertainties (e.g., China real-estate bubble).

You are not alone. We are very concerned about these risks, too. And this article describes a method that we have been using ourselves for years to only manage such risks, but also to build a successful retirement. A bit of general background about myself. My family is in the final stage toward retirement (after about 15 years of work). Through our personal journey, we feel that anyone can achieve the same, i.e., comfortable early retirement after ~15 years of work.

A key is to ALWAYS build TWO portfolios – at any stage of life. This is contrary to the popular advice of building “a” retirement portfolio or “the” perfect retirement portfolio. Whatever that portfolio is, it represents a big risk by itself. Always build 2 portfolios – one for the short-term and one for the long-term to clearly decouple the short-term risks and long-term risks. The short-term portfolio is to take care of our immediate needs (e.g., a visit to the ER next month). The long-term portfolio is to take care of things down the road (if we live to 90 years old, estate planning for our kids and grandkids, et al). These risks are never the same and shouldn’t be handled in the same way. This is diversification at a life scale!

With this background, this article describes a method to hedge the short-term risks based on SPY. The method ensures that we will have enough liquidity to meet our immediate needs no matter what the market does. It also generates some extra returns using dynamic cash allocation. As a guideline, the cash holding, the intermediate bonds, and the dividends generated by this method are able to cover about 6 months of living expenses. And the method dynamically adjusts the cash reserve when there is a loud and clear market signal to generate extra returns.

Once our short-term survival is guaranteed, I will describe the second long-term portfolio in a future article. In that portfolio, we will seek growth aggressively (by using dynamic leverage, picking more growth-oriented stocks, and so on).

Basic information

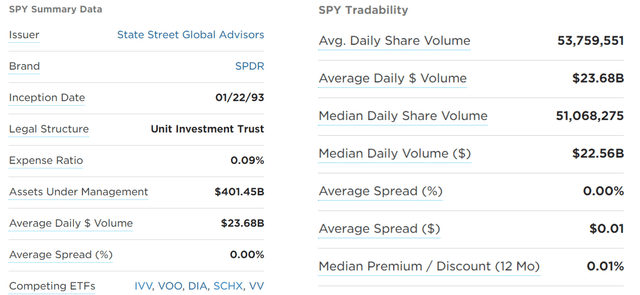

If this is one ETF fund that needs no introduction, it is probably SPY. Here we will just provide the most relevant information for ease of reference. With an AUM of more than $400B, it is one of the largest ETF funds and also the most liquid funds. And it charges a very low 0.09% expense ratio. The expense ratio might be a bit higher than some of its competing funds such as IVV or VOO. But its tradability and liquidity certainly make it up for more active investors – it boasts a daily trading volume of more than $23B and trades essentially with no spread as seen in the chart below.

Source: ETF.com

Volatility risks and valuation risks

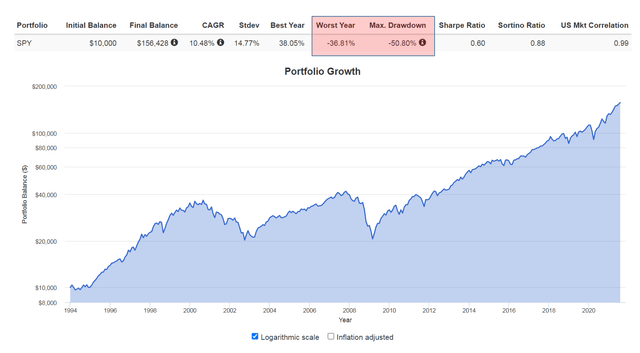

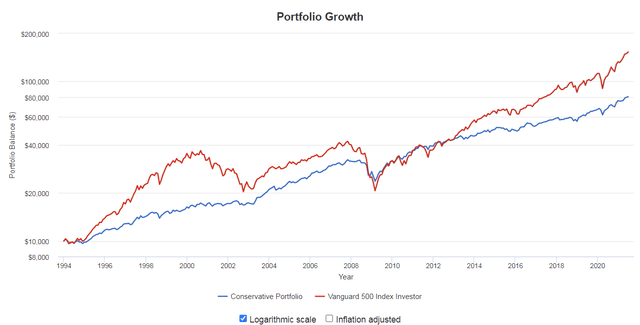

By representing the broad U.S. economy with a low fee, the fund has delivered excellent returns since its inception as shown in the next chart. The fund has delivered an annual total return of 10.5% CAGR. Resulting in a total return more of more than 15x since its inception in 1994 (assuming dividends are reinvested).

Although note that the fund’s performance comes partially as a trade-off with risks. The fund has suffered much larger volatility risks in terms of standard deviation, worst year performance, and maximum drawdowns. In particular, the fund suffered a more than 50% drawdown during the 2008 financial crisis and suffered a ~20% drawdown during the recent pandemic in 2020.

Source: Author, with simulator from Portfolio Visualizer, Silicon Cloud Technologies LLC

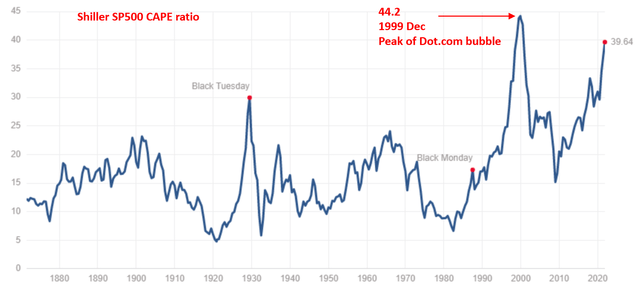

Besides the volatility risks mentioned above, the other major risk that I see at this point is the valuation risk. As can be seen from the next table, which shows the CAPE ratio for the fund. The CAPE ratio currently stands at about 39.6x, only slightly below (by about 10%) the historical record of 44.2 set in Dec 1999, at the peak of the tech bubble. As seen, the current valuation is not only “high” relative to the fund’s own history, it is actually the second high level in the stock market history since 1870.

Such a combination of high volatility and high valuation certainly increases the risk profile of the fund at this current time and calls for some hedging considerations. Therefore, in the remainder of this article, we will explore some hedging strategies to tame some of the risks.

Source: Shiller PE Ratio

Short-term survival and the conservative model portfolio

The most effective and most reliable way to hedge and ensure short-term survival is simply to hold enough cash. And the question is simply how much. Warren Buffett once made the following comments during an interview. You can see the full interview here, full of typical Buffett-style wisdom and a sense of humor. The highlights are added by me.

Yahoo Finance: how much cash should an ordinary investor have on a percentage basis?

Buffett: it depends on the personal situation… But if I were retired and I had a say $1 million diversified portfolio stocks that were paying me $30,000 a year in dividends or something of the sort… I would not worry too much about having a lot of cash around. And you can be more cash-free than Berkshire is.

So definitely the amount of cash that you should hold depends on your personal situation. In our following method, we ourselves use a conservative model portfolio to manage and dynamically adjust our cash holding. The key ideas are consistent with Buffett’s wisdom above, more specifically:

A) use six months of living expenses as a baseline and hold enough cash reserve in the portfolio to meet this baseline need,

B) then adjust it above or below the baseline only if there is a clear and loud market signal.

Here are more specifics of the conservative model portfolio. It is a variation of Ray Dalio’s All-Weather Portfolio (“AWP”) that I have developed to suit our own goals – a variation that made it more conservative and ensure our short-term survival as aforementioned. We have been and are still using the conservative model portfolio for years to build our retirement. So it is not a paper portfolio for theoretical discussion. For readers who would like to follow this method in real-time, I will keep providing regular updates of my portfolio composition and provide commentaries. The portfolio consists of:

- About 10% cash or cash equivalent. The level of cash is dynamically adjusted based on the valuation of the stock and bond market, as to be detailed below.

- About 10% gold and silver using a gold-silver trade strategy as detailed in my earlier article

- About 15% intermediate-term bonds

- About 15% long-term bonds

- The remaining are invested in stocks or stock funds with SPY as a cornerstone.

So overall, the major tweak from Dalio’s original AWP is to replace commodities with cash or cash equivalent to make it more conservative. And as aforementioned, the guiding idea is that the cash holding, the intermediate bonds, and the dividends generated should be able to meet about 6 months of living expenses.

Next, let’s see how we dynamically adjust the cash reserve when there a loud and clear signal calls for it.

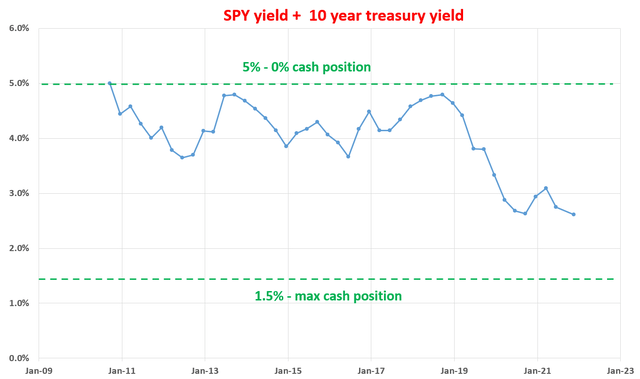

Dynamic cash allocation

The underlying idea here is quite simple and intuitive. The summation of stock yield and bond yield provides a measure of the opportunity cost of holding cash. If the summation is high, it means the opportunity cost of holding cash is high. Because I could earn a high yield if the cash is invested either from bond or stock. And I will hold less cash in this case. Vice versa, if the summation is low, it means the opportunity cost of holding cash is low. I have no good place to invest the cash because bond yield and stock market yield are low.

With this overall concept, you can see that the summation has been in the range between about 2.5% and 5% in the past decade. The 5% summation level was reached 3 times, all during times when either stock, or bond, or both are in attractive valuation. And these are the times that I would be willing to take more risks and significantly reduce my cash position to invest in the stock, bond, or both. On the other hand, when the summation becomes lower, I will begin to increase my cash holding. And when it is low enough (like it is now), I will keep increasing my cash position until I reach a ceiling around or even above the 6-months of living expenses as aforementioned.

Source: author

How did the portfolio perform?

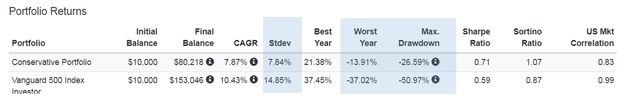

The next a few charts show the backtest results of the conservative model portfolio over a longer period of time (we have finalized the model and started executing it ourselves since about 2010). The backtest runs back to 1994 because that’s when SPY was launched. As seen, the performance of my conservative portfolio lags the overall market in general (for one thing – due to the cash holding). But it fluctuates a lot less and does a much better job preserving my capital, as seen in the next chart. As highlighted by the blue boxes, its standard deviation is about half of that of the overall market, its worst year performance is about 1/3 of the overall market, and finally, the maximum drawdown is about half of the overall market.

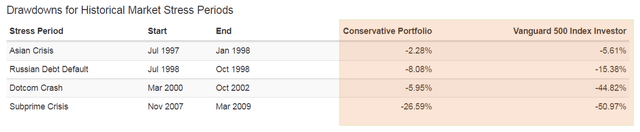

The preservation capabilities are even more impressive when we look at the historical drawdowns during all the market crises. In the past three decades or so since 1994, there have been 4 major market crises. As highlighted in the orange box, the overall US markets suffered drawdowns of 50%, 44%, 15%, and 5% respectively. In contrast, the conservative portfolio only suffered one double-digit drawdown of 26%. And all the other drawdowns are in the single-digit range, from ~2% to 8%.

Lastly, while doing an excellent job preserving capital, the conservative portfolio also kept handsome growth. The CAGR during this relatively long backtest period is almost 8%, not too far from the 10.4% offered by the overall market.

Source: Author, with simulator from Portfolio Visualizer, Silicon Cloud Technologies LLC

Source: Author, with simulator from Portfolio Visualizer, Silicon Cloud Technologies LLC

Source: Author, with simulator from Portfolio Visualizer, Silicon Cloud Technologies LLC

Conclusions and final thoughts

The SPY fund offers diversified exposure to the overall U.S. economy with a low fee and excellent liquidity. It is a cornerstone for many investors like ourselves. With the fund’s valuation near a history peak, not only its own history but the entire history of the stock market, capital preservation and short-term survival should become a priority. This article describes a method to hedge the short-term risks based on SPY. The key takeaways are:

1. Never confuse short-term and long-term risks, and always build two portfolios to decouple them.

2. Use a conservative portfolio, with sufficient cash, to ensure short-term survival. Our guideline is that the cash holding, the intermediate bonds, and the dividends generated by this method should be able to cover about 6 months of living expenses. Do not be discouraged by the performance drag due to cash holding. Its goal is not growth to start with. Its goal is to ensure short-term survival. When you have to liquidate your asset at fire-sale prices to meet short-term needs, your long-term survival is in danger.

3. Dynamically adjusts the cash reserve when there is – and when there is – a loud and clear market signal to generate extra returns. The signal I use is the summation of SPY yield and 10-year Treasury bond yield. The summation provides a measure of the opportunity cost of holding cash. If the summation is high, it means the opportunity cost of holding cash is high and vice versa. Currently, the summation is near a historical low and as a result, I am increasing my cash reserve to be slightly above the baseline and be in a hunker-down mode.

Read More: SPY ETF, Early Retirement, And Dynamic Cash Reserve (NYSEARCA:SPY)